What Is A-Khata – Meaning, Benefits & Why It Matters for Property Buyers in Bangalore

Is this property A-Khata or B-Khata? That single question now decides whether a buyer proceeds—or walks away. In Bangalore, where compliance awareness has grown sharply, A-Khata has become a symbol of safety, credibility, and future-proof investment. Buyers associate it with loan eligibility, smoother resale, and fewer legal surprises. Developers feel this shift even more strongly, as A-Khata projects attract faster closures and stronger pricing confidence. To understand why A-Khata carries this weight, it’s important to know what it truly represents and what it doesn’t.

Why A-Khata Is More Than a Buyer Concern for Developers

Buyer behaviour has fundamentally changed. Today’s buyers arrive informed, comparing A-Khata vs B-Khata, asking about A-Khata certificate samples, and evaluating whether a project can ever move from B-Khata to A-Khata. This awareness has turned A-Khata into a conversion lever.

Projects with BBMP A-Khata typically see:

- Higher-quality site visits (serious buyers, not browsers)

- Faster closure cycles due to fewer legal objections

- Stronger pricing power compared to B-Khata projects

In contrast, projects discussing B-Khata to A-Khata conversion in Bangalore often face longer negotiations and higher drop-offs.

Why Bangalore Developers Feel This More Than Other Cities

Bangalore’s planning history is uniquely fragmented, spread across BBMP, BDA, BMRDA, and BIAAPA. This has made buyers extremely sensitive to compliance. In dense urban markets, especially when marketing A-Khata plots for sale in Bangalore, buyers actively avoid ambiguity. As a result, developers feel the A-Khata pressure more strongly here than in many other Indian cities.

What Is A-Khata

Every serious property conversation in Bangalore eventually arrives at one question: “Is this A-Khata?”

So, what is A-Khata really?

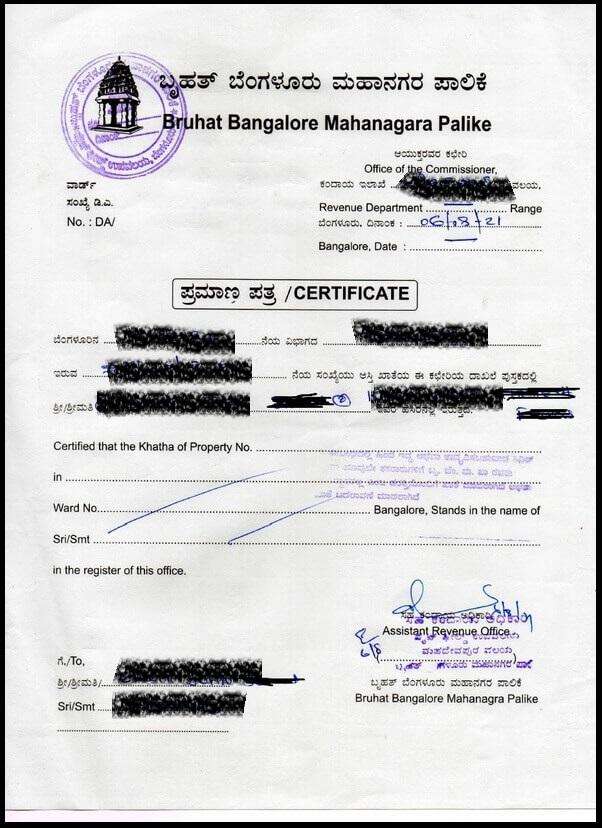

An A-Khata is a property classification issued by Bruhat Bengaluru Mahanagara Palike (BBMP) for properties that meet all applicable planning, land-use, and approval norms. It signals that the property is not merely tax-paying, but administratively and legally accepted by the city’s municipal authority.

In practical, on-ground terms, it means the city has formally acknowledged the property as compliant. It confirms that:

- The land use is approved and aligned with planning regulations

- The layout or building permissions are properly sanctioned

- The property is entered into BBMP’s primary register, not a secondary or provisional list

- The asset is eligible for loans, resale, Occupancy Certificate (OC), Completion Certificate (CC), utilities, and trade licenses

This is why an A-Khata certificate carries weight in sales conversations. It reflects municipal acceptance, not just the ability to pay property tax.

A-Khata vs Other Khata Types

In Bangalore’s real estate market, Khata type directly impacts project viability, buyer confidence, and sales velocity. The discussion around A-Khata vs B-Khata vs E-Khata is no longer limited to legal teams—it now defines buyer decisions early in the funnel. Understanding the difference between A-Khata and B-Khata helps developers position projects correctly and helps buyers avoid long-term risk.

A-Khata vs B-Khata: Developer & Buyer Implications

The difference between A-Khata and B-Khata in Bangalore becomes evident the moment a project is launched. An A-Khata property moves through the approval ecosystem with fewer obstacles. It supports a smoother approval flow, enables easier issuance of Occupancy Certificate (OC) and Completion Certificate (CC), and allows seamless access to utilities such as BESCOM power and BWSSB water. Most importantly, A-Khata is widely accepted by banks, making home loan approvals faster and more predictable.

In contrast, a B-Khata property exists in a grey compliance zone. Although property tax can be paid, approval gaps remain. This uncertainty often blocks OC and CC issuance and triggers hesitation from lenders. Buyers frequently shift the conversation toward B-Khata to A-Khata conversion, asking about conversion cost, timelines, and the latest BBMP B-Khata to A-Khata news. For developers, this means extended sales cycles, price resistance, and reduced closure efficiency.

Simply put, A-Khata accelerates projects forward, while B-Khata forces both buyers and developers into risk assessment mode.

A-Khata vs E-Khata: Digital Records vs Compliance Reality

The rise of E-Khata has improved transparency, but it has also created confusion. Many buyers assume E-Khata vs A-Khata is a question of superiority. In reality, E-Khata only digitises records—it does not certify compliance.

An E-Khata can exist for both A-Khata and B-Khata properties. While BBMP E-Khata online access helps with verification and tax tracking, it does not resolve approval gaps or legal risks. This is why informed buyers still ask for A-Khata certificate samples and clarification on what is an A-Khata property, even when E-Khata is available.

Digital Khata improves visibility, but A-Khata delivers legitimacy.

Why A-Khata Matters to Property Buyers in Bangalore

In Bangalore, buyers rarely wait until legal verification to ask about Khata status. Questions like A-Khata or B-Khata, what is the difference between A-Khata and B-Khata, and is this BBMP A-Khata now surface during the very first interaction.

Home Loan Eligibility & Bank Confidence

Banks play a major role in shaping buyer behaviour. Public sector banks strongly prefer BBMP A-Khata properties due to lower regulatory risk. Private banks may finance B-Khata properties selectively, but often with stricter conditions, lower loan-to-value ratios, or additional legal checks. As a result, buyers prioritise A-Khata properties for sale in Bangalore early in their search to avoid last-minute loan rejections.

This is why A-Khata discussions appear so early in the funnel—it directly impacts financing certainty.

Resale Value, Liquidity & Long-Term Security

From a resale perspective, A-Khata properties enjoy higher liquidity. End-users see A-Khata as long-term security, while investors view it as an easier exit asset. During resale, A-Khata property for sale in Bangalore attracts a wider buyer pool and faces less price discounting.

B-Khata properties often require justification, negotiation, and compromise—especially if theB-Khata to A-Khata conversion in Bangalore remains uncertain.

In Bangalore’s compliance-sensitive market, A-Khata is no longer optional—it is strategic. It influences loans, resale value, buyer confidence, and developer credibility. Projects backed by A-Khata don’t just sell faster—they sell with trust.

Bangalore Micro-Markets Where A-Khata Drives Demand

In Bangalore, A-Khata demand is not uniform—it intensifies in specific micro-markets where buyer profiles, ticket sizes, and lender scrutiny are higher. As awareness around A-Khata vs B-Khata grows, these zones clearly show how compliance directly shapes absorption and pricing.

East Bangalore (Whitefield, KR Puram, Sarjapur Road)

East Bangalore attracts a large base of mid-premium salaried buyers, many of whom rely heavily on home loans from PSU and private banks. In this segment, loan eligibility becomes non-negotiable, which automatically elevates the importance of the BBMP A-Khata.

Buyers here actively shortlist A-Khata properties for sale in Bangalore to avoid last-minute loan rejections. Even a well-designed project struggles to convert if the clarity of Khata is missing. As a result, developers with A-Khata land experience faster site-visit conversions and cleaner sales pipelines, while B-Khata projects face repeated questions regarding the conversion from B-Khata to A-Khata in Bangalore.

North Bangalore (Hebbal, Yelahanka, Devanahalli)

North Bangalore tells a different story—one driven by scale and institutional scrutiny. Large land parcels, plotted developments, and long-term infrastructure bets dominate this corridor. Here, buyers include HNIs, NRIs, and institutional investors, all of whom conduct deeper legal and compliance checks.

In this zone, A-Khata is treated as a baseline filter, not a differentiator. Projects without A-Khata often struggle to gain investor confidence, regardless of location potential. Questions around the difference between A-Khata and B-Khata in Bangalore surface early, especially for plotted layouts. As a result, A-Khata land commands stronger trust, higher absorption, and better exit visibility.

South & Central Bangalore (JP Nagar, Banashankari, Indiranagar)

In South and Central Bangalore, the demand for A-Khata is driven largely by redevelopment and end-use buyers. Older layouts, independent houses, and apartment redevelopments dominate these micro-markets.

Here, buyers are compliance-driven and risk-averse. They scrutinise what is an A-Khata property, ask for A-Khata certificate samples, and avoid assets that could complicate resale or reconstruction. In tightly packed urban areas, even small approval gaps can derail redevelopment plans—making A-Khata essential rather than optional.

Cost & Time Implications of Developing on A-Khata Land

While A-Khata land often comes at a premium, its project-level economics tell a different story when viewed holistically.

Higher Land Cost vs Predictable Project Execution

Yes, A-Khata land costs more upfront. However, it dramatically reduces downstream uncertainty. Developers face fewer approval hurdles, clearer zoning alignment, and minimal legal friction. This predictability shortens approval cycles and prevents costly redesigns or regulatory pauses that are common in non-A-Khata projects.

In contrast, projects banking on B-Khata to A-Khata conversion often lose time navigating policy ambiguity and evolving compliance rules.

Lower Holding Cost & Faster Sales Velocity

Time is money in real estate. Projects on A-Khata land benefit from faster buyer confidence, quicker loan sanctions, and fewer objections during legal verification. This leads to:

- Shorter sales cycles

- Lower holding costs

- Reduced inventory overhang

Ultimately, A-Khata doesn’t just reduce risk—it improves capital efficiency.

Common Developer Mistakes Around A-Khata Projects

Even with BBMP A-Khata in place, many projects underperform, not because of compliance gaps, but because of strategic missteps. In Bangalore’s evolved market, A-Khata is a strong foundation, but it is not a silver bullet.

Assuming A-Khata Alone Sells the Project

One of the most common mistakes developers make is believing that A-Khata alone guarantees demand. While A-Khata reduces legal friction, it does not automatically solve issues of market fit, pricing, or product positioning. Buyers may trust the compliance, but they still evaluate location, livability, amenities, and long-term value.

When compliance is treated as the only selling point, projects risk sounding generic. The result is stalled absorption—even with “safe” documentation. A-Khata builds confidence, but value is what converts confidence into bookings.

Poor Communication of A-Khata Benefits in Marketing

Another frequent miss is under-communicating A-Khata benefits. Many developers mention A-Khata as a footnote instead of using it as an early trust anchor. In a market where buyers actively compare A-Khata vs B-Khata, this is a lost opportunity.

Effective projects explain why A-Khata matters—loan eligibility, resale ease, lower future risk—right at the top of the funnel. When this education is missing, buyers raise objections later, slowing down closures that could have been faster.

Overpaying for A-Khata Land Without an Exit Strategy

A-Khata land often commands a premium. Problems arise when developers overpay without aligning the product and exit strategy. If ticket size, buyer segment, or absorption potential is misjudged, margins get squeezed.

In such cases, A-Khata reduces risk—but does not protect profitability. Smart developers balance land cost, pricing power, and sales velocity, instead of assuming A-Khata will automatically justify higher prices.

Strategic Framework: When A-Khata Creates Maximum Advantage

A-Khata delivers the highest leverage when used intentionally—not passively.

Ideal Project Types for A-Khata Land

A-Khata creates disproportionate advantage in:

- Mid-premium and premium apartments, where buyers depend heavily on loans

- Villas and row houses, where ticket sizes demand compliance clarity

- Redevelopment projects, where approvals, OC, and CC are non-negotiable

In these formats, buyers expect predictability. A-Khata aligns perfectly with that expectation and shortens the trust-building cycle.

Using A-Khata as a Brand & Portfolio De-Risking Tool

Beyond individual projects, A-Khata strengthens the developer brand. Portfolios built on compliant land find it easier to:

- Raise institutional capital

- Enter mandate partnerships

- Scale across micro-markets

For lenders and partners, A-Khata signals discipline and long-term intent—not just short-term execution.

How Developers Should Position A-Khata Projects to Buyers

Positioning determines whether A-Khata remains a backend checkbox or becomes a front-end advantage.

Educating Without Overselling

Buyers today are informed. Overselling compliance feels defensive. Instead, successful developers adopt transparent, confidence-led messaging:

- Explain what A-Khata ensures

- Clarify what still needs verification

- Show readiness for scrutiny

This approach builds credibility faster than exaggerated claims.

Aligning Compliance, Pricing & Buyer Segment

A-Khata works best when pricing and the buyer segment are aligned. Mid-income buyers value loan certainty. Premium buyers value long-term security and resale liquidity. When pricing reflects these expectations, A-Khata translates into faster absorption, not just safer transactions.

Conclusion

In Bangalore, A-Khata is no longer optional. It is a strategic lever that brings predictability, builds buyer trust, and supports long-term value creation. Developers who treat it as part of their go-to-market thinking—not just a legal milestone—outperform consistently. For developers, the opportunity is clear: A-Khata sets the foundation—but strategy is what scales it.

FAQs

How does A-Khata impact home loan approval for Bangalore properties?

Banks—especially PSU lenders—strongly prefer A-Khata properties because compliance lowers their risk. As a result, loan approvals are faster, documentation hurdles are fewer, and buyers avoid last-minute rejections during sanction.

Do buyers in Bangalore actively prefer A-Khata projects today?

Yes. Post-RERA, buyers ask about A-Khata early in the funnel. It has become a trust shortcut—buyers associate it with safer purchases, smoother resale, and fewer surprises during legal verification.

Which Bangalore areas have the highest demand for A-Khata properties?

Demand is strongest in East Bangalore (Whitefield, KR Puram, Sarjapur Road), North Bangalore (Hebbal, Yelahanka, Devanahalli), and South/Central zones like JP Nagar and Indiranagar, where loan dependency and compliance sensitivity are high.

Is A-Khata enough, or should buyers and developers check other approvals?

A-Khata is important, but not sufficient on its own. Buyers and developers should still verify clear title, zoning alignment, layout sanctions, OC/CC status, and encumbrance records to fully de-risk a project.

How does A-Khata influence resale value and liquidity in Bangalore?

A-Khata properties resell faster and attract a wider buyer pool. They face less discounting, shorter exit timelines, and higher liquidity compared to B-Khata or ambiguous-status properties.

Why do serious developers prioritise A-Khata land despite higher costs?

Although A-Khata land costs more upfront, it offers predictability—fewer approval delays, faster sales velocity, and stronger buyer confidence. Over the project lifecycle, this often results in better margins and scalable growth.

One thought on “What Is A-Khata – Meaning, Benefits & Why It Matters for Property Buyers in Bangalore”