Will New U.S. Tariffs Shift Your Real Estate Choices in India? The Surprising Reality

When global trade headlines seem worlds away from your personal plans, it’s easy to dismiss their relevance. However, the recent 50% US tariff on Indian goods, which took effect on August 27, 2025, demonstrates how international policy decisions can create ripple effects that ultimately reach your doorstep. While this development has sparked concerns, India’s real estate market presents a more resilient and nuanced story than initial fears might suggest.

Understanding the Tariff Reality: More Than Meets the Eye

The Executive Order 14329, signed on August 6, 2025, imposed substantial tariffs on Indian exports as punishment for India’s continued purchase of Russian oil. This positions India alongside Brazil as countries facing the highest US tariff rates, with some products experiencing total duties of up to 50%. The tariffs affect diverse sectors including apparel, precious stones, jewelry, footwear, and chemicals, threatening thousands of small exporters and jobs across India.

However, certain key sectors remain exempt from these steep tariffs, including iron and steel products, aluminum, copper goods, passenger vehicles, auto components, pharmaceuticals, and electronics. This selective approach means the impact varies significantly across different industries and regions.

Will Rising Costs Affect Your Dream Home? The Construction Reality

Despite tariff concerns, India’s construction sector remains fundamentally strong due to its domestic production foundation. India stands as the world’s second-largest steel producer, with crude steel production reaching 137.96 million tonnes in FY25. The infrastructure and construction sectors drive 65% of India’s total steel consumption, with government projects accounting for 25-30% of this demand.

The government’s “Make in India” initiative has actively reduced reliance on foreign supply chains, particularly in construction materials. Major financial institutions project India’s steel demand to grow by 9-10% in FY25, supported by massive infrastructure investments in roads, railways, metros, industrial parks, and affordable housing projects.

While some imported components may see price increases, many developers are absorbing these costs to maintain competitive pricing, ensuring the burden doesn’t transfer entirely to homebuyers. The 12% safeguard duty on steel imports imposed in April 2025 further protects domestic manufacturers from cheaper foreign alternatives.

Market Sentiment vs. Ground Reality: Indian Homebuyers Stay Confident

Despite global headlines, Indian real estate fundamentals remain robust. The sector is projected to grow from $332.85 billion in 2025 to $985.80 billion by 2030, representing a remarkable CAGR of 24.25%.

Recent market data reveals interesting trends:

- Luxury home demand (₹1 crore and above) surged 53% in 2024 across seven major cities

- In Q1 2025, 1,930 luxury homes were sold across India’s top seven cities, representing a 28% jump from the previous year

- Property registrations in Mumbai reached an all-time high of 75,672 in H1 2025, up 4% year-on-year

Consumer confidence remains strong, driven by job stability, rising incomes, and belief in the domestic economy’s resilience.

The NRI Advantage: Dollar Strength Creates Investment Opportunities

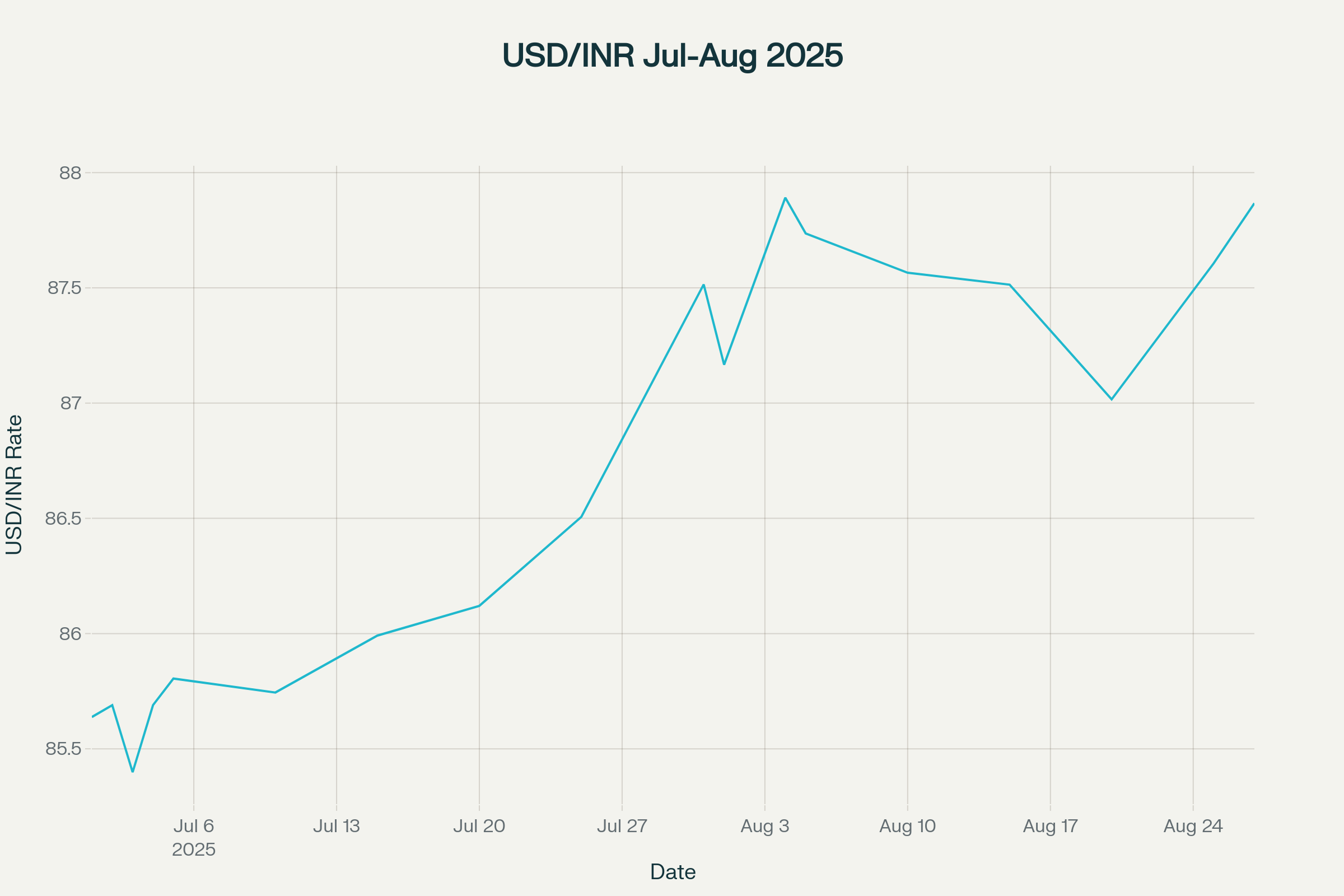

Global economic uncertainty often strengthens the US Dollar, creating a unique opportunity for Non-Resident Indians (NRIs). Current exchange rates show the dollar trading at approximately ₹87.7 per USD as of August 2025, representing significant strengthening from earlier levels.

USD to INR Exchange Rate Trend (July-August 2025) – Showing Dollar Strengthening

This dollar strength provides enhanced purchasing power for NRIs investing in Indian real estate. However, NRIs must also consider long-term currency depreciation risks. Historical analysis shows that while properties may appreciate significantly in rupee terms, currency depreciation can significantly impact dollar-denominated returns.

Gulf-based NRIs are particularly active in the Indian property market, with 15-25% of investments in new residential projects across India’s top seven cities coming from NRIs in 2024. Cities like Mumbai, Bengaluru, Pune, Delhi-NCR, and Hyderabad remain preferred destinations, offering strong rental yields and infrastructure improvements.

Government’s Strategic Response: The ₹20,000 Crore Export Promotion Mission

India is not sitting idle amid trade challenges. The government is preparing a comprehensive ₹20,000 crore Export Promotion Mission by September 2025, designed to safeguard exporters from global trade uncertainties. This mission encompasses five strategic components:

- Trade Finance: Enhanced access to credit with flexible, collateral-free loans for MSMEs

- Non-Trade Finance: Addressing regulatory challenges and market access issues

- Brand India Promotion: Elevating Indian brands to global stature

- E-commerce and Warehousing Hubs: Establishing robust logistics infrastructure

- Trade Facilitation: Improving ease of doing business through policy support

Economic Resilience: Strong Growth Projections Despite Challenges

India’s economic fundamentals remain strong despite external pressures. Deloitte projects GDP growth of 6.5-6.7% for FY2025-26, while the RBI maintains its forecast at 6.5%. This growth is supported by:

- Resilient domestic demand and easing inflation

- Strong government capital expenditure and infrastructure investment

- Robust private consumption, which accounts for over 61% of GDP

- Nearly 10 crore middle and high-income households expected to be added by 2030

Smart Investment Strategy: Why Plotted Developments Shine

In this environment, plotted developments emerge as particularly attractive investment options. Unlike apartments that depreciate over time due to wear and tear, land typically appreciates as cities expand and infrastructure develops.

Key advantages of plotted developments include:

- Lower Maintenance Costs: Minimal ongoing expenses until construction begins

- Flexibility in Construction Timing: Build when financially convenient

- Superior Long-term Value: Plots typically appreciate faster in expanding cities

- Tangible Asset Security: Land ownership provides inherent stability

In Tier 2 cities, plotted land has appreciated by 9-12% annually over the last five years, often outpacing apartment growth in many regions.

Promising Investment Opportunities

Several well-positioned plotted developments offer compelling investment potential:

Montira by Rare Earth features a Palmeraie-themed community across 14.34 acres with 116 premium villa plots in the Nandi Hills foothills, just 12 minutes from STRR and 25 minutes from Bangalore International Airport.

Sapling by Saibya offers 54 exclusive estate farm plots across 14.33 acres on Nandi Hills-Doddaballapur Road, positioned 15 minutes from STRR and 20 minutes from the Foxconn Apple Project.

Magical Spring by SID Infra presents a Mediterranean-themed luxury community across 34 acres off IVC Road, featuring over 30 lifestyle amenities and just 10 minutes from Bangalore International Airport.

Shantika by Sannidhi provides a Bali-themed luxury community across 53 acres in Malur, featuring a 27,000 sq. ft. clubhouse and strategic connectivity to major employment centers.

The Strategic Outlook: Resilience Meets Opportunity

While US tariffs present challenges, India’s real estate market demonstrates remarkable resilience through:

- Strong domestic production capabilities reducing import dependence

- Robust GDP growth projections supporting sustained demand

- Government policy support through strategic missions and infrastructure investment

- Favorable conditions for NRI investment due to currency dynamics

- Diverse investment opportunities particularly in plotted developments

The current environment creates a unique window of opportunity for strategic real estate investment. Rather than being derailed by global headlines, India’s real estate market continues to offer substantial growth potential backed by strong fundamentals and proactive government measures.

Smart investors recognize that temporary global uncertainties often create the best long-term investment opportunities. With careful selection of projects and timing, current market conditions favor those ready to look beyond the headlines and focus on India’s enduring growth story.