Stamp Duty and Registration Charges in Bangalore(Updated September 2025)

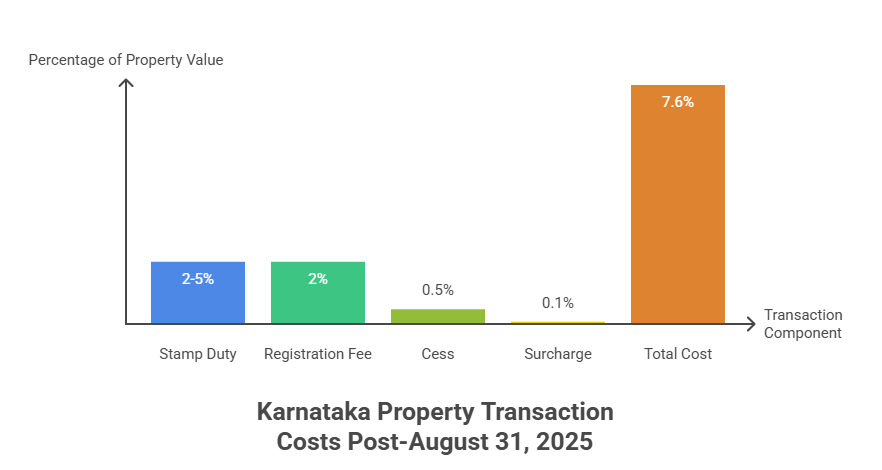

Karnataka has increased property registration fees from 1% to 2% effective August 31, 2025, making total property transaction costs 7.6% (5% stamp duty + 2% registration + 0.6% cess/charges). Stamp duty rates remain 2-5% based on property value, with circle rates determining minimum taxable value.

Property transactions in Bangalore involve significant statutory costs that every buyer, seller, and investor must understand. With Karnataka’s recent doubling of registration fees from August 31, 2025, the total cost of property registration has increased substantially. These charges directly impact your property purchase budget and vary based on property value, location, and transaction type. Understanding these costs helps you plan better and avoid last-minute financial surprises during property registration.

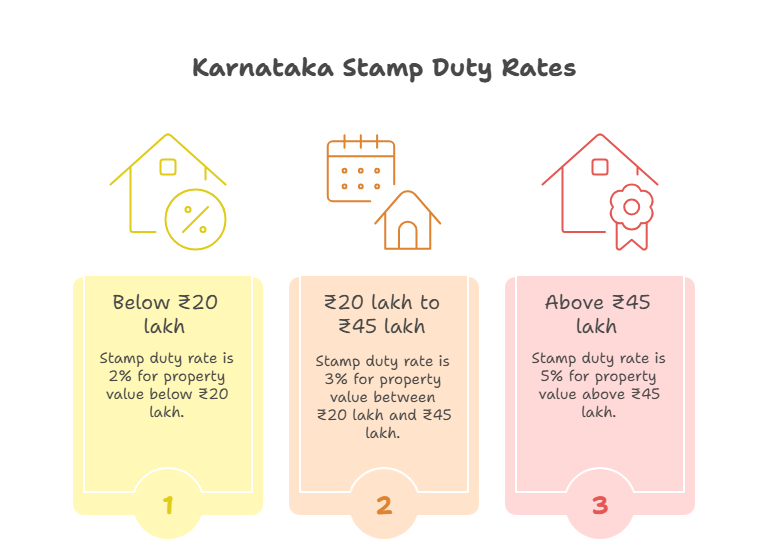

Latest Stamp Duty Rates in Karnataka and Bangalore

Karnataka follows a slab-based stamp duty structure that applies uniformly across all cities, including Bangalore. The current stamp duty rates, which remain unchanged in 2025, are:

| Property Value | Stamp Duty Rate |

| Below ₹20 lakh | 2% |

| ₹20 lakh to ₹45 lakh | 3% |

| Above ₹45 lakh | 5% |

These rates were established through Karnataka’s stamp duty framework and apply to all property types within Bangalore’s BBMP limits and surrounding areas. The stamp duty is calculated on the higher of the sale consideration or the circle rate (guidance value) set by the Karnataka government.

Important Note: No special concessions exist for first-time buyers in Karnataka, unlike some other states.The rates apply equally regardless of buyer demographics, though some sources mention a 0.5% concession for women buyers in specific circumstances.

Registration Charges: The Major 2025 Update

The most significant change in 2025 is the doubling of registration fees effective August 31, 2025. This revision, announced by the Karnataka Department of Stamps and Registration, represents the first increase since 2003.

Registration Fee Structure:

- Before August 31, 2025: 1% of property value

- From August 31, 2025 onwards: 2% of property value

Total Transaction Cost (Post-August 31, 2025):

- Stamp Duty: 2-5% (based on property value)

- Registration Fee: 2%

- Cess: 0.5%

- Surcharge: 0.1%

- Total for properties above ₹45 lakh: 7.6%

The government justified this increase to “rationalise, strengthen administrative processes and ensure better service delivery” while noting that Karnataka still maintains competitive rates compared to neighboring states.

Practical Stamp Duty and Registration Charges Calculation with Examples

New Apartment Purchase

| Property Value | Stamp Duty (5%) | Registration Fee (2%) | Additional Charges (0.6%) | Total Cost | Explanation |

| ₹50 lakh | ₹2,50,000 | ₹1,00,000 | ₹30,000 | ₹3,80,000 | 7.6% of property value for new flat purchase |

| ₹1.2 crore | ₹6,00,000 | ₹2,40,000 | ₹72,000 | ₹9,12,000 | Premium apartment with higher absolute costs |

| ₹5 crore | ₹25,00,000 | ₹10,00,000 | ₹3,00,000 | ₹38,00,000 | Luxury property with substantial statutory costs |

Plot/Land Purchase Example

For a ₹75 lakh plot in Bangalore:

- Property Value: ₹75,00,000

- Stamp Duty (5%): ₹3,75,000

- Registration Fee (2%): ₹1,50,000

- Additional Charges: ₹45,000

- Total Cost: ₹5,70,000 (7.6% of plot value)

Resale vs New Property Considerations

Resale properties attract the same stamp duty and registration rates as new properties. However, the calculation base differs:

- New Properties: Based on builder’s sale price vs circle rate (whichever is higher)

- Resale Properties: Based on market transaction value vs circle rate (whichever is higher)

Transfer duty considerations remain the same for both categories, with no separate transfer fees beyond the standard registration charges.

Circle Rate Application and Exemptions

Circle Rate (Guidance Value) in Bangalore

Circle rates, also known as guidance values, represent the minimum price at which properties can be registered in specific areas. The Karnataka government revised these values significantly in October 2023, with increases of 25-30% on average, and up to 50% in certain localities.

Key Circle Rate Areas in Bangalore:

- Prime localities (Koramangala, Indiranagar, HSR Layout): ₹10,000-20,000 per sq ft

- IT corridors (Electronic City, Whitefield): ₹5,950-9,000 per sq ft

- Developing areas (Sarjapur Road, Bannerghatta Road): ₹5,000-8,000 per sq ft

When Circle Rate Exceeds Declared Value

If the circle rate is higher than your declared transaction value, stamp duty and registration fees will be calculated on the circle rate. Property buyers should:

- Check current circle rates on the Kaveri 2.0 portal before finalizing deals

- Ensure transaction prices reflect realistic market values

- Consult with legal advisors if significant discrepancies exist

Common Exemptions and Rebates

- Gift deeds to family members: Fixed stamp duty of ₹1,000-5,000 depending on authority (BBMP/BDA)

- MSME loan agreements: 100% stamp duty exemption for certain financial instruments

- Agricultural property: Lower rates in gram panchayat areas

Step-by-Step Property Registration Guide in Bangalore

Required Documents Checklist:

- Original sale deed (duly stamped and signed)

- Encumbrance Certificate (13+ years)

- Khata Certificate and Extract (BBMP issued)

- Property tax receipts (current)

- Identity and address proof (buyer and seller)

- PAN cards (mandatory for both parties)

- Approved building plan (for new constructions)

- No Objection Certificates (if applicable)

- Power of Attorney (if representative handling)

- Stamp duty and registration fee payment receipts

Registration Process:

- Calculate charges using Karnataka IGR portal or official calculators

- Pay stamp duty through e-stamping (SHCIL) or authorized centers

- Book appointment at relevant Sub-Registrar Office through Kaveri Online

- Submit documents with originals and photocopies

- Verification process by Sub-Registrar (same day)

- Collect registered documents (15-20 working days)

Sub-Registrar Office Selection:

Choose the Sub-Registrar Office based on property location within Bangalore. BBMP areas have specific jurisdictional offices that handle property registrations.

Tips to Reduce Registration Surprises

Before Purchase:

- Verify circle rates on Kaveri 2.0 portal to understand minimum taxable value

- Get legal title verification through qualified property lawyers

- Check encumbrance certificate for past 13+ years to ensure clear title

- Confirm building approvals and completion certificates for new properties

During Transaction:

- Budget for 7.6% additional costs beyond property price for transactions above ₹45 lakh

- Keep all payment receipts for stamp duty and registration fees

- Ensure both parties are present during registration or have valid power of attorney

- Double-check all document details for accuracy before submission

Common Pitfalls to Avoid:

- Undervaluing property below circle rates to save on stamp duty (illegal and rejected)

- Missing appointment dates at Sub-Registrar Office (causes delays and re-booking)

- Incomplete documentation leading to registration rejection

- Ignoring additional charges beyond stamp duty and registration fees

Featured Projects to Watch in Bangalore 2025

Rapid urbanisation, strong IT sector growth, and extensive infrastructure development are driving Bangalore’s real estate market in 2025, which remains a dynamic and promising landscape. North Bangalore is a popular destination for both investors and homebuyers due to projects like the metro expansion and new motorways that improve connectivity and the growing demand for upscale gated communities and plotted developments. Because of this, now is the perfect time to investigate some of the most desirable residential options that blend luxury, lifestyle, and prime location.

Here are a few noteworthy projects in and around Bangalore that merit consideration due to their quality, amenities, and room for expansion before we wrap up.

- Signature One Villa, Devanahalli

- Luxury 4 & 5 BHK villas with premium amenities, 15,000 sq. ft. clubhouse, and just minutes from Bangalore International Airport.

- Luxury 4 & 5 BHK villas with premium amenities, 15,000 sq. ft. clubhouse, and just minutes from Bangalore International Airport.

- Montira – Premium Villa Plots, Near Nandi Hills

- Gated plotted development offering scenic plots with resort-like features, ideal for weekend homes or investment.

- Gated plotted development offering scenic plots with resort-like features, ideal for weekend homes or investment.

- Shantika Bali-Themed Villa Plots, Malur

- Distinctive Bali-style plotted community with lush landscaping and themed recreational spaces.

- Distinctive Bali-style plotted community with lush landscaping and themed recreational spaces.

- Magical Springs, Off IVC Road, Devanahalli Road

- Villa plots in an exclusive enclave, close to the airport and future infrastructure growth zones.

- Villa plots in an exclusive enclave, close to the airport and future infrastructure growth zones.

- Saibya Sapling Farm Estate Plots, Doddaballapur, Nandi Hills Road

- Farm estate plots designed for green living, organic farming, and tranquil weekends amidst nature.

Conclusion

Bangalore’s property registration costs have increased significantly with the August 31, 2025 fee revision, now totaling 7.6% for properties above ₹45 lakh. While these costs add substantial expense to property transactions, Karnataka still maintains competitive rates compared to neighboring states. Successful property registration requires careful planning, complete documentation, and understanding of both stamp duty calculations and circle rate implications.

Buyer Checklist

- ✅ Verify current circle rates for your property location on Kaveri 2.0

- ✅ Calculate total statutory costs (budget 7.6% for properties above ₹45 lakh)

- ✅ Gather all required documents including EC, Khata, and tax receipts

- ✅ Book Sub-Registrar appointment well in advance through official portal

- ✅ Keep payment receipts for stamp duty, registration, and additional charges

Frequently Asked Questions (FAQs)

Q2: What happens with joint property buyers - who pays the stamp duty?

A: Joint buyers pay stamp duty based on the total property value, not individual shares. The stamp duty rate remains the same regardless of the number of joint owners, calculated on the full transaction value.

Q3: Is stamp duty included in my home loan amount?

A: No, stamp duty and registration charges are separate from your home loan. These are upfront costs you must arrange independently. However, stamp duty payments qualify for income tax deduction under Section 80C up to ₹1.5 lakh for new residential properties.

Q4: In a property sale, who pays stamp duty and registration charges?

A: Traditionally, the buyer pays both stamp duty and registration charges. However, this can be negotiated between parties and mentioned in the sale agreement. Some sellers may agree to share these costs as part of the deal structure.

Q5: How do I pay stamp duty for Power of Attorney transactions?

A: Power of Attorney documents attract specific stamp duty rates. For property-related PoAs, stamp duty varies based on the transaction value and purpose. E-stamping is available through SHCIL or authorized collection centers.

Q6: What's the difference between BBMP and non-BBMP areas for stamp duty?

A: Stamp duty rates are uniform across Karnataka, but cess and surcharge calculations may vary slightly. BBMP areas have urban surcharge rates, while rural areas might have different surcharge percentages.

Q7: Can I get a refund if I pay excess stamp duty?

A: Yes, if you've paid excess stamp duty due to calculation errors, you can apply for a refund through the Sub-Registrar Office with proper documentation and proof of excess payment.

Q8: How does stamp duty work for joint development agreements (JDA)?

A: JDAs now attract the revised 2% registration fee along with applicable stamp duty based on the land value and development terms. The calculation considers the total project value and land owner's share.