Real Cost of Buying a Home in Bangalore (2026): Hidden Charges, Taxes & True Budget Guide

Most homebuyers in Bangalore begin their search by looking at advertised property prices. Unfortunately, these prices are often misleading. Builders highlight attractive numbers, but they rarely reflect the real cost of buying a home in Bangalore.

In many cases, buyers make decisions emotionally—driven by location, lifestyle promises, or fear of missing out. However, the financial reality unfolds much later. As additional charges start surfacing, buyers realise that the actual cost of buying property in Bangalore is far higher than expected.

In fact, once all charges are added, the total cost of buying a flat in Bangalore typically escalates by 20–30% over the quoted price. This gap creates budget stress, loan shortfalls, and long-term financial pressure. Therefore, this blog breaks down the Bangalore property buying costs clearly. More importantly, it reveals all hidden charges when buying a home in Bangalore, helping you plan a realistic home-buying budget in Bangalore—before you commit.

Base Price Is Not the Real Price

To begin with, builders usually showcase only the base price in brochures. This price is calculated per square foot and represents only the construction value of the home.

However, the base price excludes multiple mandatory expenses. Government charges, floor rise charges, clubhouse fees, parking costs, GST, and interiors are not included. As a result, buyers misunderstand the true Bangalore home buyer charges involved. Moreover, developers use psychological pricing. The phrase “starting from” creates affordability perception, even though very few units are available at that price. Consequently, buyers assume the base price equals the final cost.

This is precisely why many buyers underestimate the real cost of buying a home in Bangalore until late in the process.

Formula for Real Home Buying Cost in Bangalore

To avoid confusion, buyers must calculate the cost breakdown of buying a house in Bangalore using a complete formula:

- Base price

- Government charges

- Builder charges

- Legal costs

- Bank and loan charges

- Interiors

- Living setup costs

, is equal to Actual ownership cost

When all these elements are added, the actual cost of buying property in Bangalore becomes clear—and often significantly higher than expected.

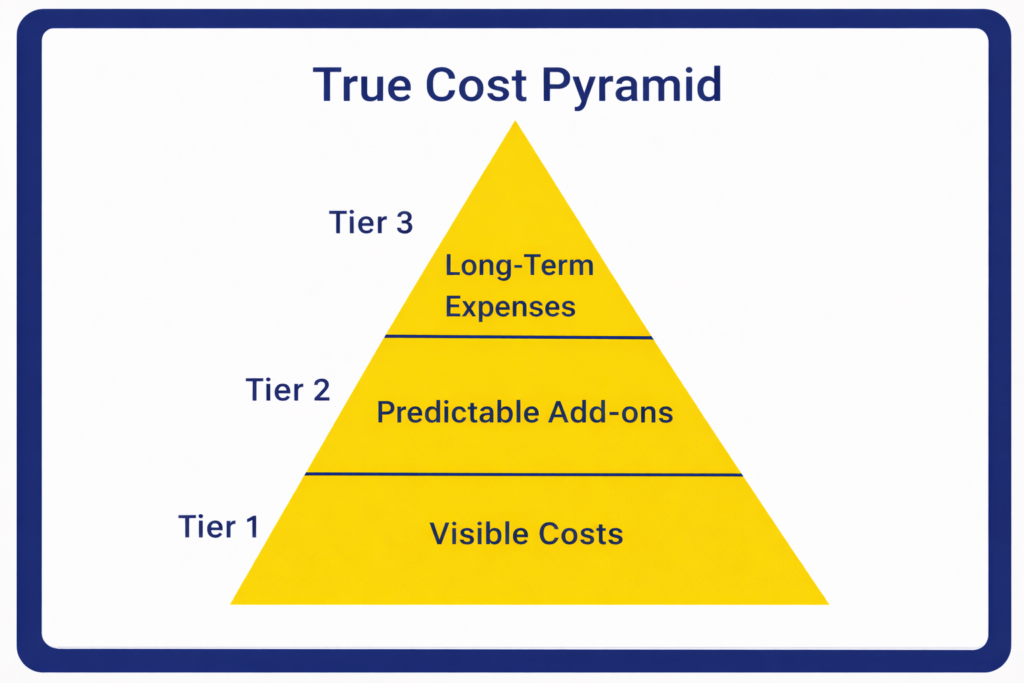

3 Financial Components of Home Buying

Ownership Setup Costs

First, ownership setup costs are unavoidable. These include stamp duty and registration, legal verification, and utility connections such as electricity, water, and gas.

In addition, interiors play a major role. Even basic interiors add substantially to home purchase expenses in Bangalore. Builders also collect maintenance deposits and corpus funds, which many buyers overlook initially.

Together, these form some of the most common Bangalore real estate hidden charges.

Capital Costs

Next come capital costs, which affect your upfront liquidity. These include the booking amount, down payment, GST on under-construction properties, and agreement value mismatches.

Often, loan eligibility is calculated on a lower agreement value. As a result, buyers must arrange additional funds, increasing their Bangalore property buying costs unexpectedly.

Long-Term Costs

Finally, long-term costs shape real ownership affordability. Monthly EMI burden, annual maintenance charges, property tax, and sinking fund contributions continue throughout ownership. Over time, future renovation, repainting, and upgrades further increase the real cost of buying a home in Bangalore.

Hidden Charges Breakdown

Once buyers move past the brochure price, the real expenses begin to surface. These Bangalore real estate hidden charges are rarely discussed upfront, yet they form a significant portion of the real cost of buying a home in Bangalore. To plan your home-buying budget in Bangalore accurately, you must understand each category in detail.

Government Charges

To begin with, government charges are mandatory and non-negotiable. These costs apply to every property transaction, regardless of the builder or project type.

Stamp duty is the largest component and is calculated as a percentage of the agreement value or guidance value, whichever is higher. Next comes registration charges, payable at the time of property registration. Together, these alone can add several lakhs to the total cost of buying a flat in Bangalore.

Additionally, buyers must account for cess and surcharge, which are often bundled into stamp duty but still increase the final outflow. Finally, Khata transfer charges apply after registration to legally record the property in the buyer’s name with the local authority. As a result, government charges significantly raise the actual cost of buying property in Bangalore, even before possession.

Builder Charges

After government costs, builder charges form the most confusing part of Bangalore property buying costs. These charges vary widely and are often disclosed only during booking or agreement stages.

To start with, parking charges are usually billed separately, even though buyers assume they are included. Floor-rise charges increase the price for higher floors, while PLC (Preferential Location Charges) apply for park-facing, corner, or premium-view units.

In addition, builders collect clubhouse and amenity charges, which are not part of the base price. Buyers also pay a corpus fund and maintenance deposit, intended for long-term upkeep but payable upfront. Moreover, utility infrastructure fees for electricity, water, sewage, and generators add further strain to the budget. When combined, these builder-specific costs form a major share of hidden charges when buying a home in Bangalore.

Bank & Loan Charges

Even buyers who opt for home loans face additional expenses. While loans reduce upfront burden, they increase home purchase expenses in Bangalore in less visible ways. First, banks charge a processing fee, usually calculated as a percentage of the loan amount. Next, legal and technical verification fees are charged for evaluating property documents and construction approvals.

Furthermore, MODT (Memorandum of Deposit of Title Deeds) charges apply when the bank registers the mortgage. Buyers must also pay CERSAI charges, which record the loan against the property to prevent multiple borrowings. Although these amounts appear small individually, together they add noticeably to the Bangalore home buyer charges.

Legal & Compliance Costs

Smart buyers invest in independent legal checks to reduce risk. While optional, these costs protect buyers from future disputes and losses. An independent lawyer verification ensures clean ownership and legal clarity beyond the builder’s documents. Encumbrance Certificate (EC) verification confirms there are no outstanding loans or disputes on the property.

In addition, lawyers conduct a title flow check to validate ownership history. Buyers should also verify RERA registration, ensuring the project is legally approved and timelines are declared.

Finally, OC (Occupancy Certificate) and CC (Completion Certificate) verification is critical, especially for ready properties. Skipping these checks may reduce upfront cost but dramatically increase long-term risk—making them a hidden but essential part of the real cost of buying a home in Bangalore.

Under-Construction vs Ready-to-Move Cost Comparison

Choosing between under-construction and ready-to-move properties directly impacts Bangalore property buying costs. Under-construction homes attract GST, increasing the purchase cost immediately. They also carry higher risk factors, such as project delays and specification changes. Moreover, possession timelines are uncertain, which often leads to overlapping rent and EMI payments.

In contrast, ready-to-move homes do not attract GST. However, they demand immediate interior investment, since buyers move in quickly. While risk is lower, the upfront cash outflow is higher.

Overall, under-construction homes may appear cheaper initially but accumulate more hidden charges over time, while ready-to-move homes demand higher immediate liquidity but offer cost certainty. Understanding this distinction is essential for planning the true cost breakdown of buying a house in Bangalore, not just the advertised price.

Real Example Cost Breakdown (₹1 Crore Property Model)

Let’s convert theory into reality with a ₹1 crore advertised property in Bangalore.

- Base price: ₹1,00,00,000

- Stamp duty & registration: ₹6–7 lakhs

- Parking: ₹3–5 lakhs

- Floor-rise & PLC: ₹2–4 lakhs

- Amenities & clubhouse fees: ₹2–3 lakhs

- Legal & loan charges: ₹1–2 lakhs

- Utility connections: ₹1–2 lakhs

- Interiors (basic livable): ₹8–12 lakhs

- Minor fixes & move-in setup: ₹1–2 lakhs

Final actual cost: ₹1.25–1.30 crore

This is the actual cost of buying property in Bangalore, not the brochure price. Most buyers discover this gap too late.

Interior Cost Reality

Interiors are the most underestimated part of home purchase expenses in Bangalore. Buyers assume interiors are optional. In reality, they are unavoidable.

Basic interiors only make a home livable. Premium interiors upgrade lifestyle—but both cost money. Model flats further distort expectations by showcasing luxury finishes that are not included.

A smarter approach is a phased interior strategy. Prioritise essentials first, then upgrade gradually. This controls cash flow without compromising comfort.

Emotional & Lifestyle Costs Buyers Ignore

Beyond financial numbers, lifestyle shifts quietly increase the Bangalore home buyer charges.

Furniture upgrades happen naturally when moving into a “better” home. Relocation costs, new commuting routes, fuel expenses, and cab dependence add monthly pressure.

Lifestyle inflation follows. Better societies mean higher spending. School shifts, activity fees, and social adaptation costs add to long-term strain. These expenses don’t appear in cost sheets—but they impact budgets.

Smart Cost-Control Strategies

Fortunately, buyers can reduce the real cost of buying a home in Bangalore with planning. Always ask for a full cost sheet upfront. Negotiate PLC and parking—they are often flexible. If cash flow matters, consider ready-to-move homes to avoid GST.

Compare banks instead of accepting the first loan offer. Plan interiors in phases. Maintain an emergency fund before buying. Most importantly, follow the EMI-to-income ratio rule to avoid lifestyle stress.

Buyer Safety Checklist Before Booking

Before paying a booking amount, verify everything:

- Clear title verification

- Clean Encumbrance Certificate (EC)

- Valid RERA registration

- OC/CC availability for ready properties

- Independent legal report

- Bank legal clearance

- Detailed cost sheet

- Clear payment milestone structure

Buyer Type Cost Strategy

- First-time buyers: Focus on cash flow and emergency buffers

- Investors: Prioritise entry price, rent yield, and exit costs

- End-users: Balance comfort with long-term affordability

- NRIs: Account for currency risk and management costs

- Retirees: Avoid EMI-heavy purchases

- Professionals: Plan for lifestyle inflation and job mobility

Each buyer type faces a different cost breakdown of buying a house in Bangalore.

Conclusion for Cost of Buying a Home in Bangalore

In Bangalore’s real estate market, the base price is only the entry point—not the real cost. What truly matters is everything that follows: taxes, charges, interiors, financing, and long-term ownership expenses. Buyers who focus only on advertised prices often underestimate the real cost of buying a home in Bangalore, leading to budget overruns and financial stress. In contrast, informed buyers plan for the full picture and make decisions with confidence.

Understanding the actual cost of buying property in Bangalore is not about being cautious—it is about being financially responsible. When you account for every hidden charge and future expense, you protect your savings, your lifestyle, and your peace of mind. Ultimately, a home is not just an emotional milestone. It is a long-term financial commitment. The smarter the planning, the smoother the ownership journey—and the safer your financial future.

FAQs on Cost of Buying a Home in Bangalore

How much extra money should buyers keep for hidden charges?

Buyers should keep 10–15% extra over the base price to comfortably cover taxes, interiors, and unexpected costs.

Does GST apply on Bangalore properties?

GST applies only to under-construction properties (usually 5% without ITC). Ready-to-move homes with OC have no GST.

What are the biggest hidden charges when buying a flat in Bangalore?

Common hidden charges include parking, floor-rise, PLC, clubhouse fees, legal charges, and utility connection costs.

Is parking included in flat price in Bangalore?

Usually no. Most builders charge separately for car parking, and it can significantly increase the final cost.

What is the real interior cost after buying a flat?

Basic interiors can cost ₹6–10 lakhs, while premium interiors often go beyond ₹15–25 lakhs, depending on size and quality.

Are builder cost sheets transparent?

Not always. Many cost sheets hide add-ons in fine print, so buyers must ask for a fully itemised final cost sheet.

Which is cheaper: under-construction or ready-to-move property?

Under-construction homes look cheaper upfront but include GST and waiting risk. Ready-to-move homes avoid GST and surprise costs.

How can buyers reduce the total cost of buying a home in Bangalore?

Negotiate PLC and parking, choose ready-to-move options, plan interiors in phases, and always compare the final all-inclusive price.

How much are stamp duty and registration charges in Bangalore?

Stamp duty is usually 5% and registration is 1% of the agreement value, plus minor surcharge and cess.

One thought on “Real Cost of Buying a Home in Bangalore (2026): Hidden Charges, Taxes & True Budget Guide”