Why Plotted Development Near STRR Is the Next Big Thing in Real Estate

Smart investors aren’t just looking at Bangalore— they are circling it. You’ve heard the buzz about STRR. Here is why people are rushing to own plots there:

As Bangalore rapidly expands beyond its traditional city limits, the demand for strategic land investments is surging, making Plotted Development one of the hottest segments in real estate today. Among the emerging hotspots, plots in the Satellite Town Ring Road (STRR) are witnessing unprecedented traction due to their seamless connectivity, affordability, and future-ready infrastructure.

According to recent reports, peripheral Bengaluru—especially areas along the STRR corridor—is showing a double-digit rise in plotted land inquiries year-on-year. With the STRR project set to decongest city traffic and link key hubs like Devanahalli, Hosur, Hoskote, and Tumkur, investing in plotted development near STRR is not just smart—it’s strategic.

What is Plotted Development and Why It’s Gaining Ground

Plotted development refers to the division of a large parcel of land into smaller, saleable plots, often within a gated or semi-planned layout. Each plot comes with clear legal titles and basic infrastructure such as roads, electricity, water supply, and drainage, making it ready for construction. Unlike apartment living, plotted development offers buyers the freedom to design and build their own homes at their own pace and budget.

In recent years, Plotted Development in Bangalore has seen a significant surge in demand, particularly among young professionals, first-time investors, and non-resident Indians (NRIs). With the city’s real estate landscape shifting beyond traditional hotspots, plotted developments are emerging as flexible, future-ready alternatives to vertical housing.

So, why the sudden spotlight? First, plotted developments are relatively affordable when compared to built-up properties, allowing buyers to enter the market with a lower initial investment. Second, the appreciation potential is high, especially when located in growth corridors like STRR, making it a smart investment for wealth building. Lastly, plots offer unmatched customisation: whether it’s a weekend home, rental villa, or a long-term investment, the options are open.

For those looking to invest in a tangible, appreciating asset with full ownership and creative freedom, plotted development is no longer just an option—it’s the strategy. And in a rapidly expanding city like Bangalore, it’s hard to ignore.

Understanding STRR: Bangalore’s Most Strategic Infrastructure Project

The Satellite Town Ring Road (STRR) is one of Bangalore’s most ambitious infrastructure undertakings, poised to reshape the city’s urban planning and real estate growth. Designed as a 204 km ring, STRR will encircle the city by connecting major satellite towns including Devanahalli, Hoskote, Hosur, Ramanagara, Kanakapura, and Tumkur, offering seamless transit and decongesting inner-city traffic.

Developed under the Bharatmala Pariyojana by the National Highways Authority of India (NHAI), STRR is being executed in phases, with the first phase between Dobbspet and Ramanagara already underway. Completion of the entire corridor is expected by 2026, and the project is backed by substantial central and state government funding, signalling strong administrative priority.

For real estate investors, STRR is unlocking new growth zones where land is still reasonably priced and infrastructural potential is massive. Naturally, Plotted Development around this ring is gaining traction, as buyers foresee tremendous appreciation once connectivity is fully realised. Areas along this corridor are already witnessing a spike in inquiries for Plots in STRR, with developers launching premium gated layouts targeting both end-users and investors.

As Bangalore’s development expands outward, STRR is becoming a game-changer. Its strategic location, robust government backing, and integration with other infrastructure like the STRR-Peripheral Ring Road (PRR) and suburban rail make Plots in STRR a future-proof investment for those looking to ride the next wave of plotted growth.

STRR-Connected Hotspots: Plotted Developments You Can’t Miss

As Bangalore’s infrastructure expands outward, the Satellite Town Ring Road (STRR) has become the new compass for high-potential land investments. Areas like Devanahalli, Hoskote, and Hosur—once on the city’s fringes—are now buzzing with activity, thanks to their proximity to STRR and upcoming infrastructure projects.

- Type: Luxury Villas

- Location: Bangalore International Airport Road, Devanahalli

- Highlights: Ultra-luxury villas with top-notch amenities, situated in a rapidly developing area with excellent connectivity to STRR and the airport.

- Type: Premium Villa Plots

- Location: Devanahalli, North Bangalore

- Highlights: A serene plotted development offering a blend of nature and modern living, with easy access to STRR and other major infrastructures.

3. NBR Meadows

- Type: Premium Villa Plots

- Location: Hosur

- Highlights: Strategically located in Hosur, this project offers premium villa plots with excellent connectivity to Bangalore and the upcoming STRR, making it a lucrative investment opportunity.

- Location: Devanahalli, North Bangalore

- Type: Premium Villa Plots

- Highlights: Situated in a rapidly developing area with proximity to the airport and STRR, offering luxury amenities and serene surroundings.

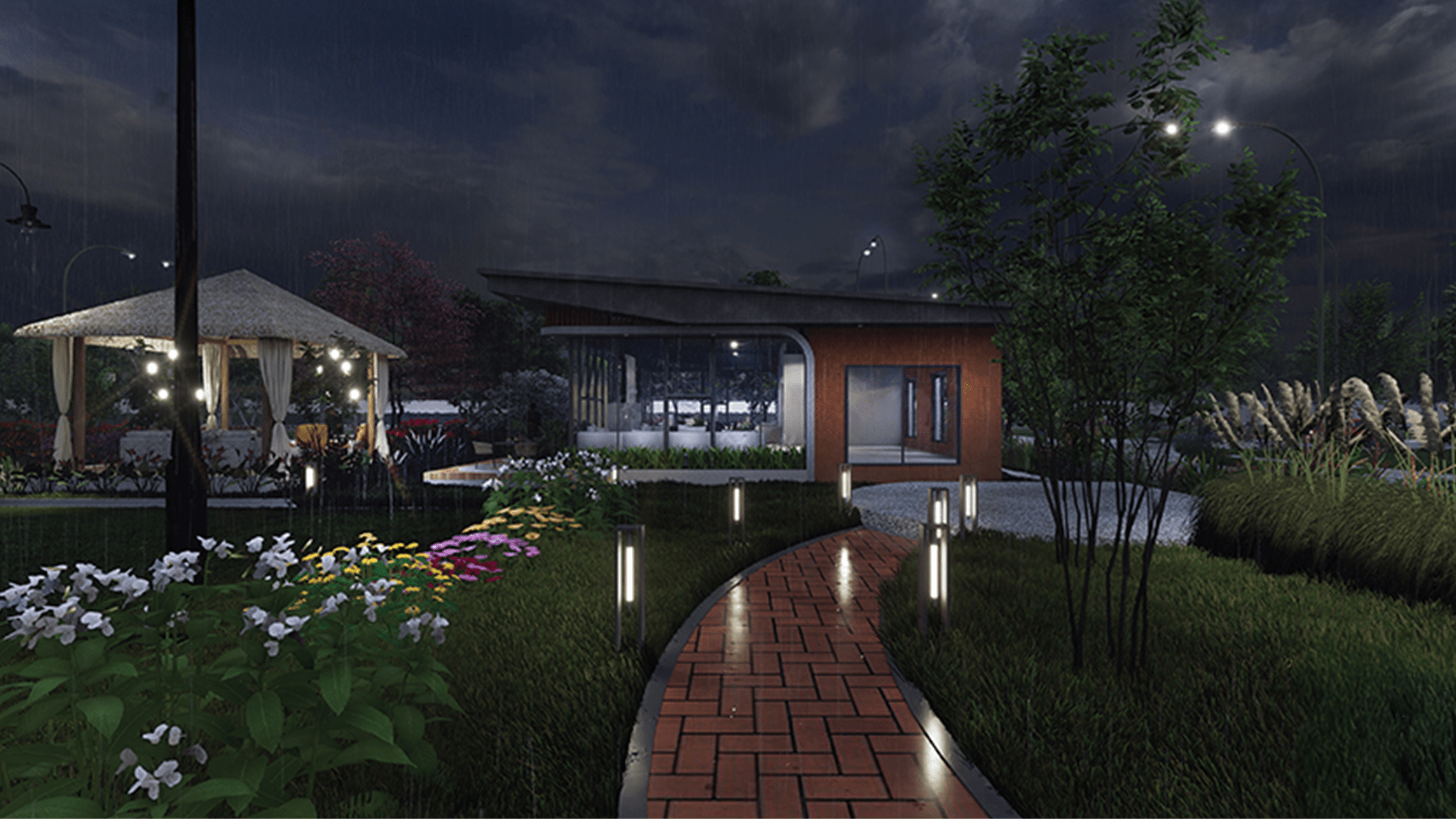

Whether you’re an end-user looking to build your dream home or an investor eyeing long-term appreciation, these zones offer some of the most promising Plotted Development opportunities. Here’s a curated list of Houzbay’s standout projects offering premium plots in STRR-connected corridors—each designed to deliver connectivity, growth, and lifestyle.

Final Thought

As Bangalore continues to sprawl outward, the Satellite Town Ring Road (STRR) is becoming the backbone of the city’s next wave of real estate growth. With its ability to connect emerging micro-markets like Devanahalli, Hoskote, and Hosur, STRR is not just easing traffic—it’s opening the doors to high-potential investment corridors.

For buyers and investors alike, Plotted Development in these zones offers a rare blend of affordability, appreciation potential, and future-ready infrastructure. Whether you’re planning to build your dream home or diversify your portfolio, plots in STRR provide unmatched flexibility and long-term value.

In a city that has transformed villages into IT hubs and townships into landmarks, STRR is your signal to get ahead of the curve. The time to invest in plotted development near STRR isn’t next year. It’s now.

Frequently Asked Questions (FAQs):

2. How much cheaper are plots near STRR compared to central Bangalore?

STRR plots are 50-70% cheaper than central Bangalore. While central areas cost ₹8,000-₹15,000/sq ft, STRR corridor plots range from ₹1,800-₹5,000/sq ft. This price gap will narrow once STRR is operational, making current investments highly attractive.

3. Which are the best locations for plotted development along STRR?

The most promising locations for plotted development along STRR include Devanahalli, which offers excellent airport proximity and tech park development at ₹3,000-₹7,000 per sq ft. Hoskote has emerged as a strong industrial growth center with plots ranging from ₹2,200-₹4,000 per sq ft, while Doddaballapur is developing as an IT corridor with affordable options at ₹2,000-₹3,500 per sq ft. The Sarjapur-Attibele stretch benefits from IT hub expansion and commands ₹4,000-₹6,000 per sq ft, and Hosur Road offers a balanced mix of industrial and residential development at ₹3,500-₹5,500 per sq ft. Each location provides unique advantages with infrastructure development and strong appreciation potential.

4. What is the expected ROI from STRR plotted development investments?

Investors can expect robust returns from STRR plotted developments across different time horizons. In the short term of 2-3 years, annual appreciation rates of 15-25% are realistic given the infrastructure development momentum. Medium-term investments over 5-7 years have the potential to deliver 5x to 10x returns, similar to what early investors experienced with Bangalore's Outer Ring Road development. Long-term holders over 7-10 years can expect significant appreciation as satellite towns mature into self-sustaining ecosystems. Historical data from similar infrastructure projects like ORR and NICE Road shows that early investors achieved 8-12x returns, making STRR a compelling investment opportunity for patient capital.

5. What approvals should I check before buying STRR plots?

Before purchasing plots in the STRR corridor, ensure the project has proper DTCP, BMRDA, or BDA layout approval, which is mandatory for legal construction. RERA registration is essential for plotted developments with 8 or more plots, providing buyer protection and transparency. Verify that agricultural land has been properly converted to residential or commercial use through DC conversion certificates. Environmental clearances are particularly important for large layouts and should be verified with local authorities. Additionally, obtain NOCs from relevant authorities including pollution control boards and fire departments. Avoid revenue layouts, non-converted agricultural land, and projects without RERA registration as these carry significant legal and financial risks.

6. Are there risks in STRR plotted development investments?

Main Risks: Project delays, oversupply, regulatory changes.

Mitigation: Buy RERA-approved projects, choose multi-growth locations, diversify investments, use legal experts for verification.

7. Can NRIs invest in STRR plotted developments?

Yes, NRIs can freely invest under FEMA regulations. Benefits include no special permissions needed, flexible payment options, strong USD appreciation potential, and easy repatriation of proceeds.

8. Why choose plots over apartments for STRR investments?

Plotted developments offer superior investment advantages over apartments, particularly in growth corridors like STRR. Plots provide complete design freedom allowing investors to build according to their vision and timeline, unlike apartments with limited modification options. The appreciation potential is significantly higher, with plots in infrastructure corridors typically delivering 15-25% annual returns compared to moderate apartment appreciation. Plots have no ongoing maintenance charges or society fees that eat into rental yields, while apartments require monthly maintenance payments. Privacy and independence are inherent benefits of plot ownership, offering space and freedom that shared apartment living cannot match. Additionally, plots provide investment flexibility as buyers can choose when to build based on market conditions and personal finances, rather than being forced into immediate possession scenarios with apartments.

9. What other infrastructure is planned along STRR?

Beyond the ring road itself, STRR will feature comprehensive infrastructure development that will transform the corridor into thriving ecosystems. Metro extensions are planned to connect satellite towns with Bangalore's main metro network, while suburban rail integration will provide seamless connectivity through the Bangalore Suburban Rail Project. New industrial parks and logistics hubs will create employment opportunities, attracting residents to these areas. Educational institutions including universities and technical colleges are being planned to serve the growing population, alongside multi-specialty hospitals and healthcare facilities. Commercial infrastructure including shopping malls, office complexes, and entertainment centers will ensure residents have access to all modern amenities, creating self-sufficient satellite towns that reduce dependency on central Bangalore.

10. When is the best time to invest in STRR plots?

Timeline: Phase 1 partially operational, full completion by 2027.

Investment Strategy: Invest now before completion. Historical data shows maximum appreciation occurs 2-3 years before infrastructure completion. Early ORR/NICE Road investors saw highest returns when they bought 3-5 years before completion.