Devanahalli Or Yelahanka: Where Should You Invest?

Introduction

Plots have always been the go-to for investors, and in 2026, the story remains the same.

In fact, if you have the capital, plots are the best mode of investment if done right.

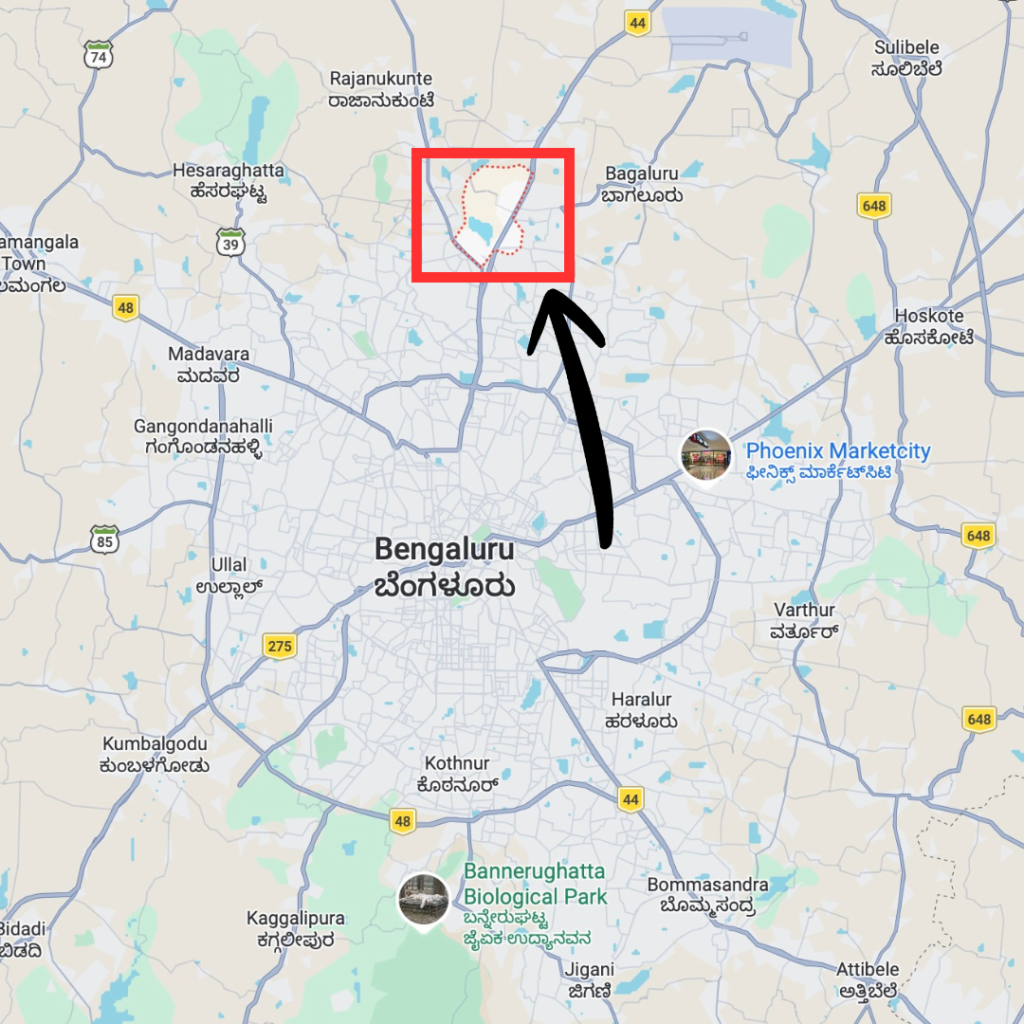

A report from Bangalore mentioned a whopping 66% increase in property prices per square foot in the last 5 years. The percentage is an average, which means the increase isn’t consistent everywhere.

For example, North and East Bangalore are leading the increase in per square foot prices.

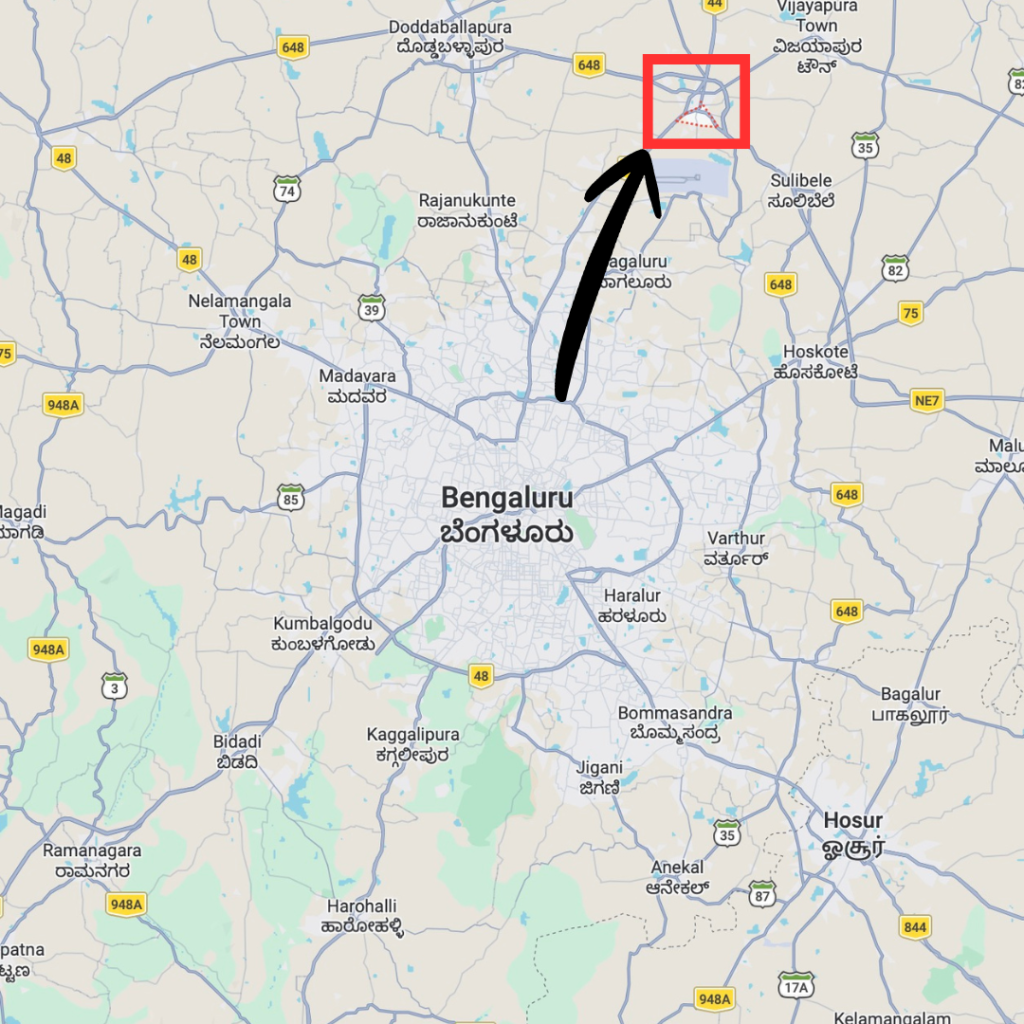

And that is the topic of our discussion today: If you plan on investing in a plot, should you go for Devanahalli or Yelahanka?

Devanahalli – North Bangalore’s Next Big Thing?

Let’s jump right in and start with Devanahalli: Why it might be the next big thing for Bangalore plots.

Closer Is Better!

You’ve probably heard the saying: Time is money.

And that is exactly what Devanahalli provides.

Time.

You want to explore North Bangalore, you’re halfway there, free of all the traffic.

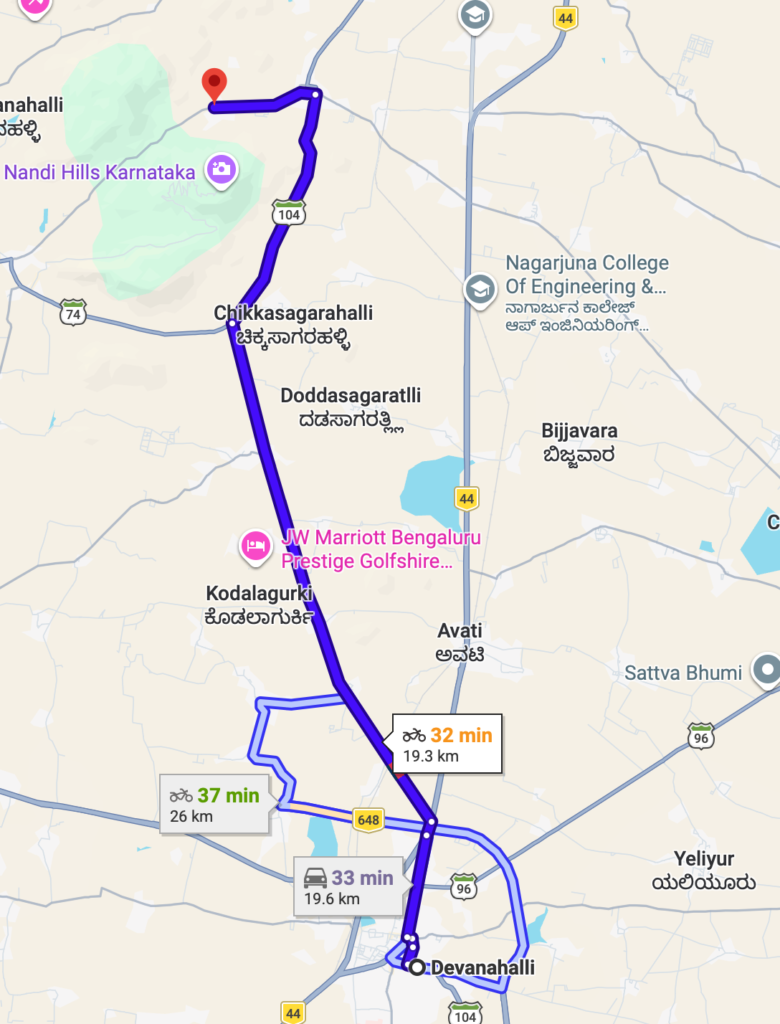

Be it a ride, weekend getaway to Nandi, or general sightseeing, Devanahalli will save you precious hours that you’d waste otherwise.

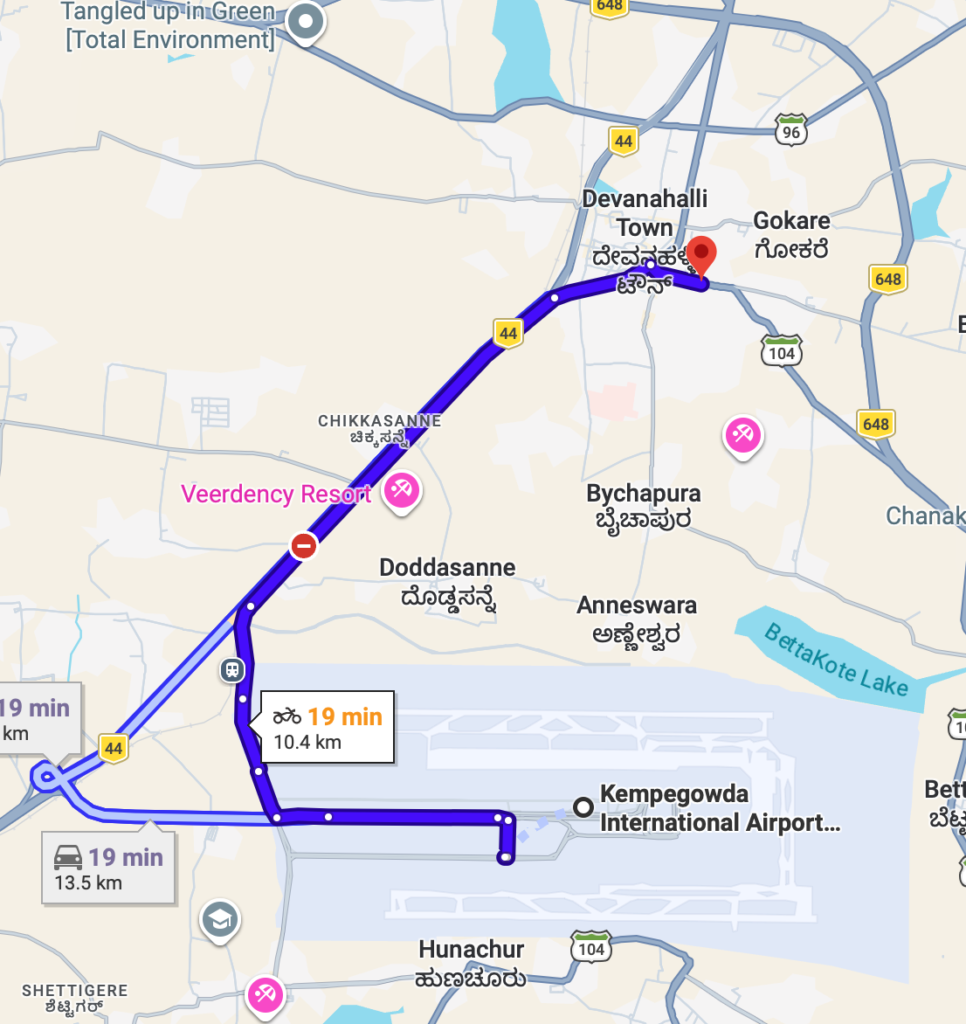

The airport is 10-13 kms away and it’ll take you about 20-25 mins to reach.

It takes ~1hr to reach the airport from Central Bangalore. Frequent flyers will understand and cherish this difference.

Then there’s the list of upcoming projects.

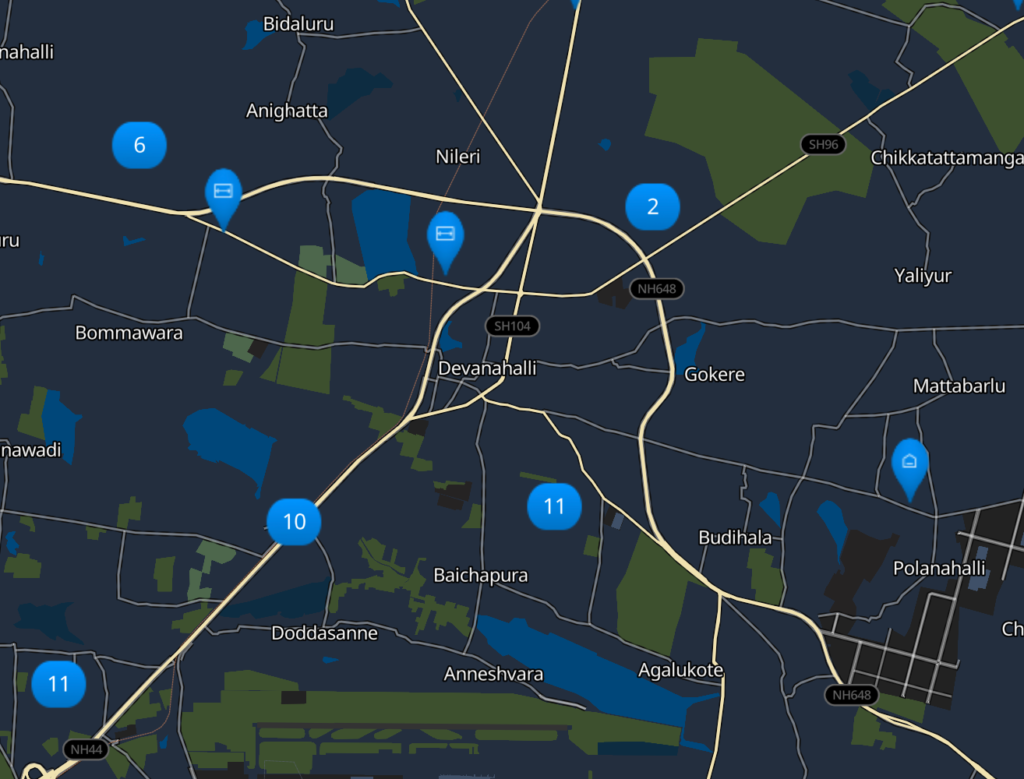

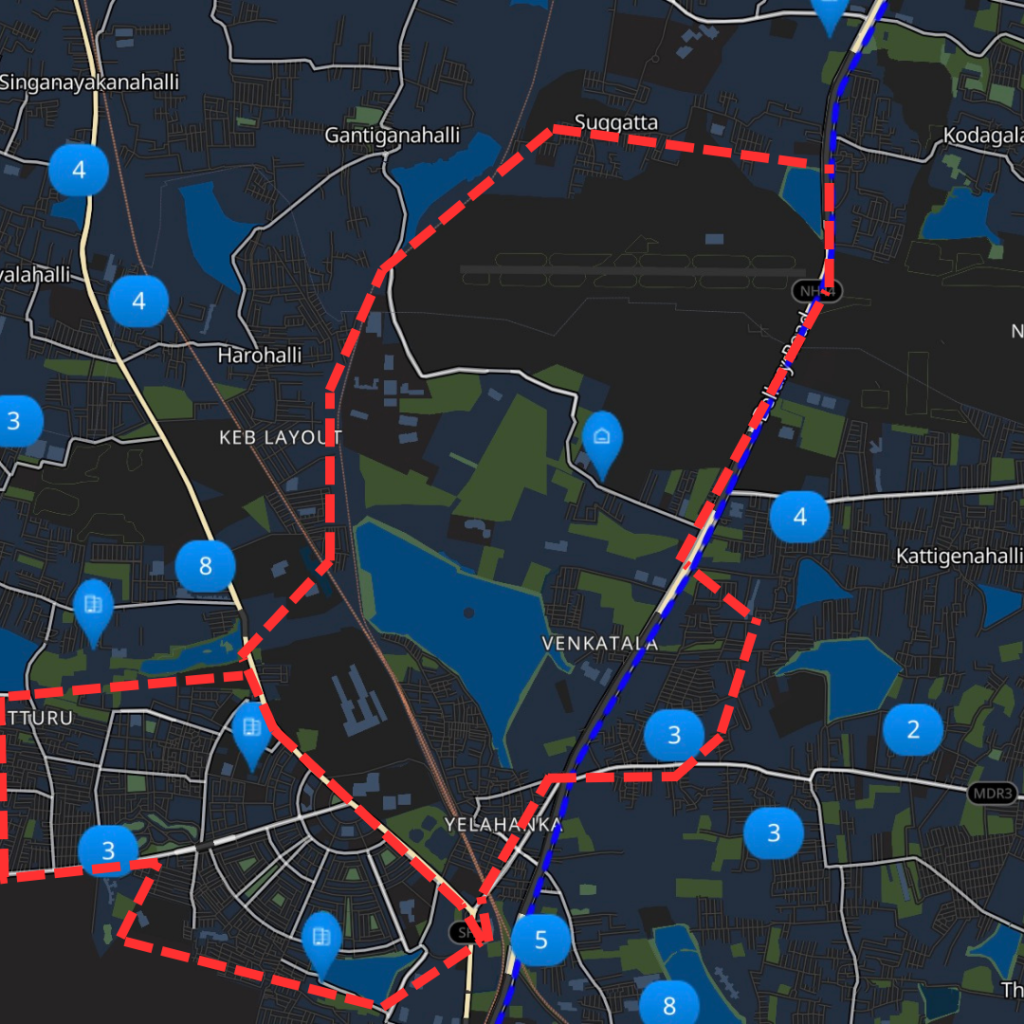

See those blue pins with numbers?

Those are the number of gated projects that either already exist or will exist in the near future. The map is public and you can access it quite easily.

In short: Save time by being close to the airport and places like Nandi Hills, Avalabetta, etc. While also having the peace of mind that multiple gated community projects are being built.

Infrastructure & Planning

Now let’s talk about something most people tend to ignore.

Infrastructure.

Because the thing is, a location might look empty today, but if it’s properly planned, its future is bright.

Devanahalli isn’t growing haphazardly.

It’s not one of those areas where buildings just pop up wherever land is available. A large portion of this region falls under structured planning. Residential zones are clearly marked.

Commercial areas are identified. Industrial and aerospace zones are separated.

If you’re thinking “Why does this have to do with me?”

Well, it has everything to do with you.

You see, the fact that the plots are zoned, means there’s little to no chance of any surprise later on. You won’t wake up one day to find a noisy warehouse right behind your future villa plot.

Quick question: Have you driven through old Bangalore areas recently?

If you have, you’ll relate to this, and if you haven’t, well, you will know now: Narrow roads. Tight turns. Zero parking. Endless congestion.

Basically a headache simulator.

Now, compare that with developing regions like Devanahalli. Because it’s still expanding, the roads are being designed for future traffic, not just current demand.

Wider internal roads. Larger arterial connections. Planned link roads.

Today it may feel “open.”

A few years later? That same openness becomes a luxury.

Another thing to note is, city centers are very saturated. Mixed-use everywhere. Commercial spilling into residential. Infrastructure stretched thin.

Devanahalli doesn’t carry that baggage, yet.

There’s more breathing space. More land parcels. More controlled layouts. Especially in plotted developments.

It Keeps Growing!

We’ve talked about the airport being near and for good reason: Airports change real estate markets. With expansion plans increasing passenger and cargo capacity, you’re looking at more employment, more commercial activity, more hospitality, more movement.

If you’re an investor, you understand that airport-led regions won’t be “cheap” forever.

The Aerospace SEZ has brought in serious players. Aerospace and defense companies setting up operations here means high-skilled, high-income professionals working in the vicinity.

And what do professionals eventually look for?

Homes. Rental properties. Plots. Villas.

Employment hubs will create real demand.

Devanahalli Business Park

Now imagine this.

Large-scale commercial activity within the same region. Office spaces. Business ecosystems. Corporate movement.

What comes after commercial growth?

Residential growth!

And that’s how appreciation cycles begin.

ITIR / Tech Hubs

North Bangalore has been discussed as a tech corridor for years now.

Even if implementation phases move slowly, the intent and direction are clear: Technology and industrial expansion is shifting northwards.

If you plan to invest in plots here, that means one thing:

Devanahalli won’t be just a weekend getaway zone anymore, it’ll turn into an employment-driven micro-market.

STRR, PRR & Metro Phase Discussions

Connectivity changes everything.

The Satellite Town Ring Road (STRR), Peripheral Ring Road (PRR), and metro expansion discussions may sound technical, but it’s really simple.

Connection with the rest of Bangalore.

And once a location is connected seamlessly with the city, the perception on price will change as distance won’t be a drawback anymore.

Investment Profile

Let’s be honest.

Devanahalli rewards a certain type of buyer.

Affordable Land Entry Pricing

Compared to established areas like Yelahanka or central Bangalore, entry prices are still relatively accessible. That’s exactly why many investors enter early.

Lower entry + infrastructure pipeline = room to grow.

But remember, you need to be patient. You cannot rush into these types of things.

High Future Appreciation Potential

If you’re looking for quick flips, Devanahalli is not it.

Unless a sudden boom happens, you are better off looking somewhere else to invest. But, if you can be patient, and hold out for 7-10 years, that’s where you’ll start seeing some gains.

This is essentially long-game territory.

You know who are the most likely players of this game?

NRIs!

Why?

Because NRIs don’t need to use it immediately and they’re comfortable thinking long-term.

If you’re someone who thinks, “Let me buy where tomorrow’s demand will be,”

Devanahalli will make sense to you.

Suitable for Luxury Plotted Developments

Large land parcels allow developers to create proper gated communities. As you could see from the image of the gated community map from earlier.

- Wide internal roads.

- Clubhouses.

- Open green space.

- Low density layouts.

You don’t get that easily in saturated parts of the city anymore.

And over time, premium plotted developments tend to age better than overcrowded ones.

Yelahanka – Strong Today, Stronger Tomorrow

Now that you are aware of Devanahalli in terms of plot investment, it’s time to look at the second option, which is also growing steadily.

Multiple Benefits Detected In The Proximity

Yelahanka doesn’t promise you the “next big thing.”

Rather it shows you what already exists, quietly.

And when it comes to buyers, this difference makes or breaks their decisions.

Let’s start with location comfort.

Yelahanka sits in a sweet spot.

You’re close to Manyata Tech Park, which immediately brings a steady working professional crowd into the picture.

Hebbal is well within reach, which means smooth connectivity toward central Bangalore. And yes, the airport is accessible too, but without that psychological feeling of being “too far out.”

You can access everything with ease, while not being on the edge.

Now that balance is powerful.

Established Infrastructure

Here’s where Yelahanka becomes very different from developing corridors.

Look at the map of Gated Communities in Yelahanka:

(alt text: Red outline showing the area of Yelahanka with blue pins marking the spots for upcoming/built gated communities)

The blue pins show the upcoming/built gated communities in and around Yelahanka.

You’re not betting on future infrastructure. You’re stepping into infrastructure that already exists and is thriving.

Good schools and colleges are operational. Hospitals are established. Retail spaces, supermarkets, and malls are part of everyday life. Families don’t have to think “how long before this area becomes livable?”

Because it already is.

Even basic civic infrastructure, roads, drainage, public spaces, reflects maturity. The area feels lived-in and organized.

And for many buyers, that reduces anxiety dramatically.

Growth Drivers

Yelahanka’s growth story is less about projection and more about presence.

IT and employment hubs nearby create steady housing demand. People working in Manyata and surrounding zones prefer staying within reasonable commute distance and Yelahanka fits that bracket comfortably.

Residential density here isn’t a future possibility.

It’s visible today.

Apartments are occupied. Independent homes are active. Rental boards don’t stay up for too long. That’s an important distinction.

In speculative zones, you wait for demand to arrive.In Yelahanka, demand is already here.

Then you add metro connectivity discussions and ongoing infrastructure upgrades into the picture, and you’re looking at a growth that has a steady upward movement.

Investment Profile

Yes, pricing in Yelahanka is slightly higher compared to emerging pockets like Devanahalli.

But that premium reflects ecosystem maturity.

You’re paying for immediacy. For rental potential. For resale liquidity. For an active end-user market.

Appreciation cycles here tend to move faster because demand is active, not waiting to be triggered.

And if you ever need to exit, the buyer pool is wider: families, working professionals, conservative investors.

If Devanahalli rewards patience, Yelahanka rewards stability.

It’s the kind of location where even cautious buyers feel comfortable committing capital.

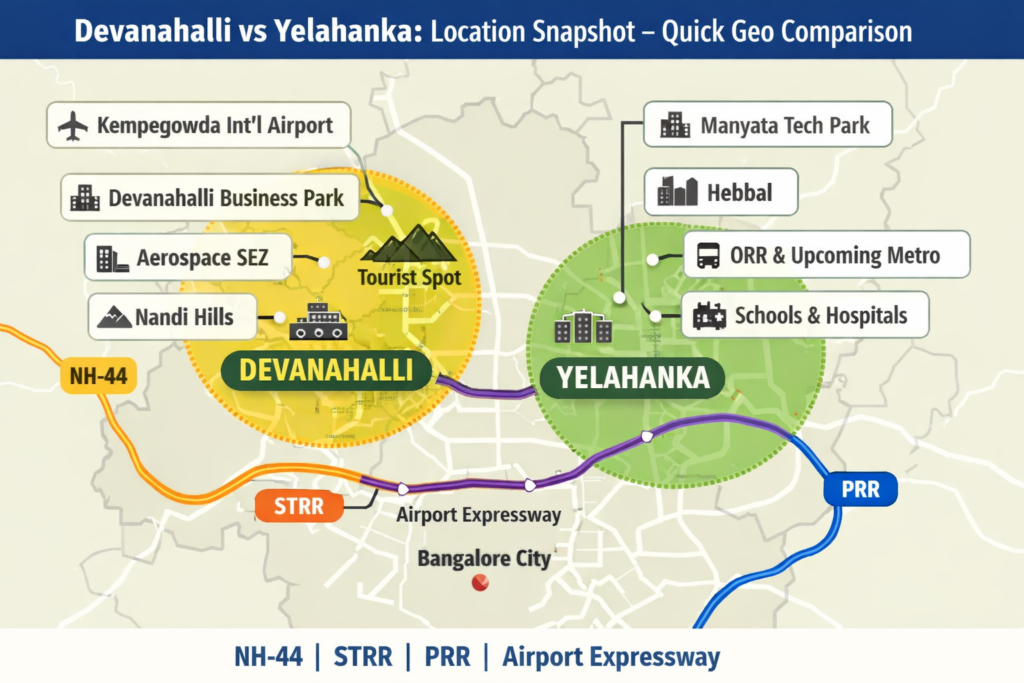

Location Snapshot: Where Are These Two On The Map?

Where Are They Located?

If you look at North Bangalore geographically, the airport acts like a northern anchor.

Move slightly south and you hit Devanahalli first. Come further down and you reach Yelahanka. Continue toward Hebbal, and you’re entering core Bangalore.

Yelahanka sits between expansion and establishment.

It benefits from NH-44 connectivity. It links smoothly toward Hebbal. It taps into airport access without feeling isolated.

Upcoming infrastructure like STRR, PRR, and Airport Expressway corridors strengthen the larger belt, but Yelahanka already enjoys integration with the city’s movement patterns.

Devanahalli feels like positioning yourself near the future.

Yelahanka feels like positioning yourself within the present.

And that’s the real comparison.

What Should YOU Choose?

| Investor Type | Best Location | Reason |

| Long-Term ROI Investors | Devanahalli | Mega Infra + Land Value Growth |

| NRIs | Devanahalli | Airport + Global Connectivity |

| Speculators / Land Bankers | Devanahalli | Early Stage Appreciation |

| Families / End-Users | Yelahanka | Livable Today |

| Working Professionals | Yelahanka | Closer to City + IT Hubs |

| Conservative Investors | Yelahanka | Lower Risk + Stable Returns |

Devanahalli vs Yelahanka: A Head-to-Head Comparison Table

| Factor | Devanahalli | Yelahanka |

| Investment Type | Long-Term | Short to Mid-Term |

| Current Infrastructure | Developing | Fully Established |

| Growth Driver | Airport + SEZ + Business Parks | IT Hubs + Residential Demand |

| Accessibility | Excellent for Future | Excellent Today |

| Pricing | Affordable | Premium |

| End-User Suitability | Medium | Very High |

| Risk | Medium | Low |

| Rental Demand | Growing | Strong |

Why Do You Need This Comparison?

As humans, we have a tendency to compare.

It is in our nature that we know if we are making the ‘better’ decision.

If you’ve been tracking Bangalore real estate even casually, you’ve probably noticed one thing: North Bangalore is no longer just “developing.”

It’s dominating conversations.

A big reason for that shift is the airport economy. Airports don’t just move people; they move industries, businesses, and eventually entire residential ecosystems.

Kempegowda International Airport has slowly transformed the northern belt into a high-activity zone that blends business growth with lifestyle convenience.

That transformation has caught the attention of NRIs and global investors as well. For many of them, airport-connected real estate feels familiar and globally validated.

It shows that there will be long-term economic sustainability rather than short-term speculation.

At the same time, regions like Devanahalli and Yelahanka are creating a rare mix of lifestyle and business advantage.

One offers future growth positioning, while the other offers present-day stability. And if you’re someone planning to enter the plotted development space, understanding that difference becomes crucial.

Because ultimately, it’s not just about location comparison.

It’s about understanding your own risk appetite and investment timeline.

Price Trends & ROI Expectation (Indicative Logic-Based Outline)

How Does The Price Behave In Devanahalli?

Devanahalli operates on what many investors call the “early entry advantage.”

The base land pricing is still relatively lower compared to established zones.

And in real estate, lower entry prices often creates a larger runway for appreciation, especially when infrastructure and employment corridors are still expanding.

The price movement here is closely tied to airport-driven economic activity.

As cargo expansion, aerospace industries, business parks, and connectivity projects layer themselves over time, land values tend to rise in phases rather than instantly.

That means the upside potential can be strong, but it usually rewards buyers who are comfortable holding property for longer periods.

How Does The Price Behave In Yelahanka?

Yelahanka tells a very different pricing story.

Since it’s already an established residential and commercial ecosystem, land prices have crossed the early growth stage. Instead of sharp jumps, appreciation here tends to follow steady, consistent movement.

What drives this stability is end-user demand.

Families, working professionals, and rental markets continuously support pricing strength. Properties don’t just depend on investor sentiment, they depend on people actively living and working in the area.

For many buyers, this creates confidence.

Growth will feel less dramatic compared to emerging corridors, but the key factor is predictability.

Risks & Reality Check

No comparison is complete without talking honestly about risks.

Every micro-market has them.

The key is understanding whether those risks match your comfort level.

What Are The Risks In Devanahalli?

Devanahalli’s biggest strength: Future growth, is also its biggest risk.

Much of its value appreciation depends on how quickly infrastructure and commercial ecosystems fully mature. Delays in large-scale projects can slow down price movement in the short term.

Another factor is investor-heavy participation.

Markets dominated by investors sometimes experience sharper sentiment shifts. When investors hold long-term, prices remain stable. When they exit collectively, temporary volatility can appear.

And above all, Devanahalli requires patience.

If you expect quick resale or immediate construction viability, you will find the waiting period challenging.

What Are The Risks In Yelahanka?

Yelahanka, on the other hand, carries a different type of risk.

The entry price is higher, which automatically means the appreciation percentage may not feel as dramatic as emerging zones.

Since the area is already mature, most growth tends to be incremental rather than explosive. For aggressive investors chasing high-growth corridors, Yelahanka will feel slightly conservative.

But for buyers prioritizing stability and usability, that same conservativeness can feel reassuring.

You Should’ve Seen This Coming

Alright, this was an interesting comparison.

Like when someone asks who’d win in a fight: Muhammad Ali or Mike Tyson.

There’s no simple answer. Devanahalli and Yelahanka are the same yet very much different.

The same goes for Yelahanka and Devanahalli: They might be places, but they cater to different people.

If you scrolled down directly, here’s the answer to Devanahalli vs. Yelahanka:

For Long-Term Wealth Creation → Devanahalli

For Balanced Growth + Livability → Yelahanka

While no one can predict what the future will look like, there are certain factors based on which one can make an informed decision.

Those factors are:

- Budget

- Time horizon

- Purpose (Investment vs End-Use), and

- Risk appetite

FAQs

Is Yelahanka already saturated, or does it still have appreciation potential?

Yelahanka is more mature, but mature doesn’t mean stagnant. It has strong end-user demand because people are already living, renting, and working nearby. Appreciation here tends to be steady rather than explosive. It may not double overnight, but it benefits from consistent demand and limited fresh land supply, which supports gradual price growth.

Are plots in Devanahalli and Yelahanka legally A-Khata or B-Khata?

Both locations can have A-Khata or B-Khata properties — it depends on the specific layout. A-Khata properties are fully compliant and loan-friendly, while B-Khata properties are in a legal grey zone and may face financing or construction restrictions. Many newer layouts in peripheral areas start as B-Khata until full approvals are completed. Always verify the specific plot’s status instead of assuming based on location.

Do I need DC Conversion (DC Converted Land) before buying a plot in either location?

Yes. If the land was originally agricultural, DC Conversion is mandatory to legally use it for residential purposes. Without it, you cannot get building approval or a bank loan. Whether you’re buying in Devanahalli or Yelahanka, this is non-negotiable. Never rely on verbal assurances, always ask for the official conversion order.

Are there any land dispute or litigation risks in Devanahalli compared to Yelahanka?

Legal risks exist in both areas, but they differ slightly. Devanahalli has more newly converted agricultural land, which increases the importance of document verification. Yelahanka, being older, has more established layouts, but even there, unauthorized layouts exist. The risk isn’t about the area; it’s about the specific project and its approvals.

Is the layout in Devanahalli / Yelahanka approved by BDA, BMRDA, or BIAPPA?

Approval authority depends on jurisdiction. Parts of Yelahanka may fall under BDA or BBMP, while Devanahalli typically comes under BMRDA or BIAPPA due to its proximity to the airport. What matters is that the layout has approval from a recognized planning authority, not just a panchayat clearance.

What legal documents should I verify before buying a plot in these locations?

At minimum, verify the Mother Deed, Encumbrance Certificate (15–30 years), DC Conversion Order, Approved Layout Plan, and Khata Certificate. If it’s a developer project, check RERA registration as well. Skipping any of these can expose you to serious legal or financial complications later.

Are there cases of fake approvals or unapproved layouts in Devanahalli?

Yes, especially in rapidly developing belts. Some layouts are marketed with incomplete approvals or only panchayat permissions. Buyers sometimes discover later that full authority approval was never obtained. This isn’t unique to Devanahalli, but peripheral areas generally require extra caution. Always cross-check approval numbers with the relevant authority.

Do both locations require the same government approvals or are rules different?

The legal requirements are essentially the same: DC Conversion (if applicable), layout approval from the correct authority, and valid Khata documentation. The difference lies only in which authority governs the area. The legal compliance checklist remains consistent regardless of location.

Are there any land acquisition or government project impact risks in Devanahalli?

Because Devanahalli is still evolving and tied to major infrastructure expansion, certain pockets may fall under future road widening or public project zones. That doesn’t mean every plot is at risk, but buyers should review master plans and ensure the property isn’t marked for acquisition. Due diligence is especially important in growth corridors.