Buying Plots in Bangalore 2025-26 – A Complete Investment Guide

Bangalore isn’t just a city; it’s the backdrop to millions of dreams. From the bustling energy of its tech parks to the serene green spaces that offer a break from the pace, this city represents a future filled with promise. For many aspiring homeowners and investors, that promise translates into a strong desire to buy a plot in Bangalore — not just as an investment, but as a foundation for building a life that’s truly their own.

While apartments have their appeal, there’s something timeless about owning land. A plot in Bangalore isn’t just a transaction; it’s the first step toward crafting a home that’s uniquely yours — a sanctuary for your family and a legacy to be proud of. It represents freedom, stability, and the ultimate expression of ownership in one of India’s most vibrant cities.

But with this great promise comes a sea of questions and uncertainties. The process of buying plots in Bangalore can feel overwhelming, with legal jargon, complex approvals, and the fear of making a wrong choice. This comprehensive guide serves as your trusted companion on this journey — helping you navigate every step with clarity and confidence, turning your dream of owning land in Bangalore into a secure and rewarding reality.

Why Buying a Plot in Bangalore Makes Perfect Sense

In 2025-26, the decision to buy a plot in Bangalore isn’t just about owning land — it’s about securing your place in one of India’s fastest-growing and most future-ready cities. As infrastructure projects like the Peripheral Ring Road (PRR), Namma Metro expansions, and Satellite Town Ring Road (STRR) reshape the urban landscape, new investment corridors are emerging across East, North, and South Bangalore.

Unlike apartments that depreciate over time, plots in Bangalore appreciate steadily, offering flexibility, control, and higher long-term returns. With reputed developers launching premium villa plotted communities in hotspots like Sarjapur Road, Whitefield, Devanahalli, and Attibele, 2025-26 presents an unmatched window to invest in land that grows with the city’s progress.

Bangalore Market Overview

When it comes to strategic land investment, few cities in India — or even across Asia — match the promise and resilience of Bengaluru’s real estate market. Several prime and tech-corridor micro-markets in Bengaluru have registered annualized growth of 12–15% mover the past 4–5 years, particularly in areas such as Bagaluru (≈90% in 5 years) and Whitefield (≈80% in 5 years) (Hindustan Times, 2024). At a city-wide level, average property values have appreciated by around 10–12% annually, with Q2 2025 alone recording a 12% rise in base selling prices despite a marginal dip in sales (Hindustan Times, 2025).

This trajectory is not accidental but rather the outcome of a confluence of powerful growth drivers — world-class infrastructure expansion, sustained IT/tech-sector demand, and Bengaluru’s unique position as India’s most resilient and future-ready real estate market.

1. The Silicon Valley of India

Bengaluru’s global recognition as the technology and innovation capital of India continues to attract multinational corporations, Fortune 500 companies, and a thriving startup ecosystem. The resulting influx of high-income professionals creates a robust and ever-expanding demand for residential and plotted developments, thereby driving sustained value appreciation.

2. Infrastructure-Led Transformation

The city is undergoing a transformative infrastructure revolution with multi-billion-dollar investments in expressways, ring roads, metro expansions, and airport-linked corridors. These projects are not merely enhancing connectivity; they are strategically unlocking new micro-markets and establishing previously underdeveloped zones as tomorrow’s prime investment hubs. For discerning investors, this represents an unparalleled opportunity to capture value before these regions fully mature.

3. A Magnet for Talent and Aspirations

Bengaluru has cemented its reputation as a career powerhouse, drawing some of the best talent from across India and the globe. Its blend of cosmopolitan culture, world-class educational institutions, and a vibrant professional landscape ensures a constant inflow of aspirants and achievers. This perpetual demand directly translates into consistent housing requirements, positioning land as one of the most secure and appreciating asset classes within the city.

4. The Enduring Allure of Land

Unlike built assets, land offers investors flexibility, scalability, and timeless value. In Bengaluru, where demand outpaces supply in strategically located growth corridors, plots represent a finite commodity with an ever-increasing premium. Investors are not only buying into land but into the future of India’s most dynamic and globally connected metropolis.

Bangalore 2025 Real Estate Market Landscape

The year 2025 marks a defining phase in Bengaluru’s real estate evolution, presenting a rare window of opportunity for astute investors to secure long-term value in land. Plot pricing in many suburban and growth-corridor micro-markets now spans from approximately ₹3,000 to ₹11,500 per sq. ft., depending on location, connectivity, and development status. This range reflects not just affordability at the lower end, but also the premium that established suburbs command at the higher end. Investors today can align their portfolios with their risk appetite — whether that means entering early in emergent corridors or acquiring plots in well-developed premium zones.

Suburban Corridors as the Growth Epicenters

A striking feature of the present landscape is the unprecedented demand concentration in suburban and peripheral zones. Areas once considered distant are now transforming into self-sufficient investment hubs due to world-class infrastructure projects, improved mobility networks, and proactive state-driven planning initiatives. These corridors are rapidly attracting residential demand, catalyzed by:

The Shift from Core to Growth Corridors

- Proximity to employment clusters in IT and industrial belts

- Connectivity via new expressways, metro expansions, and STRR corridors

- Lifestyle-driven developments including international schools, healthcare institutions, and retail hubs

Read More: Why Plotted Development Near STRR Is the Next Big Thing in Real Estate

While central Bengaluru continues to command premium valuations, it is the peripheral corridors that are driving the next wave of exponential appreciation. Investors who secure land in these evolving micro-markets stand to benefit from capital values that could double within short to mid-term cycles, fueled by infrastructure upgrades and expanding job markets.

A Balanced Opportunity for All Investor Profiles

Whether one seeks affordable entry points for wealth creation or ultra-premium plots in master-planned communities, the 2025 landscape ensures strategic entry opportunities across all budget brackets. This democratization of land ownership, combined with Bengaluru’s enduring status as a global talent magnet, makes the current cycle especially attractive.

2025 is not just another year in Bengaluru’s property cycle; it is a turning point where suburban corridors transition into tomorrow’s prime addresses, offering investors the chance to participate in one of the most significant growth narratives in Indian real estate.

Top Locations to Buying Plots in Bangalore 2025-26

When it comes to land investment, location is the single most decisive factor. It is not merely about choosing a pin on the map; it is about aligning yourself with the trajectory of a corridor’s future. The right choice can transform a purchase into a generational asset, while the wrong one can stall appreciation. Bengaluru, with its multi-directional growth and robust infrastructure pipeline, offers investors several high-potential zones to consider.

1. Buying Plots in North Bengaluru – The Airport Growth Corridor

Over the past decade, North Bengaluru has witnessed the most remarkable transformation, evolving from a quiet suburb into a global business and investment hub. The presence of Kempegowda International Airport, combined with mega projects such as the Aerospace SEZ, business parks, and logistic hubs, has turned this corridor into one of the fastest-growing investment destinations in India.

- Devanahalli

Often referred to as the epicenter of North Bengaluru’s growth story, Devanahalli has emerged as a powerhouse for both residential and commercial investments. The average plot price stands at ₹6,550 per sq. ft , offering a wide entry spectrum. Its strategic proximity to the airport, IT parks, and SEZs makes it a preferred choice for both end-users and investors. - Hebbal and Yelahanka

These micro-markets are already well-established with strong social and physical infrastructure. Their connectivity to the airport, Outer Ring Road, and central Bengaluru has ensured sustained demand. Given their maturity, plot prices here are on the higher side. The average plot rate in Hebbal, Bengaluru is ₹13,000 per sq. ft., while in Yelahanka it is ₹8,200 per sq. ft., making them a relatively safe and stable investment option. - Bagalur and Hennur

These emerging corridors are attractive alternatives for investors seeking affordability today with the potential for strong appreciation tomorrow. The average land rate in Bagalur, Bengaluru, is ₹4,500 per sq. ft., while on Hennur Road it is ₹10,000-12,000 per sq. ft., making them compelling options that balance affordability and growth potential. - Nandi Hills

Known for its picturesque landscapes and serene environment, Nandi Hills has become a hotspot for weekend homes, luxury villas, and plotted developments. The average land rate here is ₹4,000 – 4,500 per sq. ft. The market caters to both mid-segment buyers and ultra-premium investors seeking lifestyle-driven assets.

2. Buying Plots in East Bengaluru – The IT Powerhouse

If North Bengaluru is about future potential, East Bengaluru represents present-day strength. Often considered the nerve center of India’s IT industry, this corridor combines employment, infrastructure, and lifestyle, making it a magnet for investors and end-users alike.

- Whitefield

The undisputed tech capital of Bengaluru, Whitefield is home to numerous IT parks, multinational corporations, and a thriving social ecosystem. The Namma Metro extension has further enhanced its connectivity and boosted real estate values. The average land rate in Whitefield, Bengaluru is ₹16,000-20,000 per sq. ft., reflecting its established stature as a high-demand market. - Sarjapur Road

Strategically located near the Outer Ring Road and major IT corridors, Sarjapur Road has witnessed tremendous appreciation over the last few years. Land prices here range from ₹8,000–₹10,000 per sq. ft., making it one of the most sought-after residential corridors that blends premium living with strong rental yields.

3. Buying Plots in South Bengaluru – Tradition Meets Modernity

South Bengaluru is known for its cultural depth, established communities, and strong social infrastructure. Unlike the airport-led boom in the north or the IT-driven growth in the east, the south offers a blend of heritage, lifestyle, and steady appreciation.

- Kanakapura Road

Nestled amidst greenery yet well-connected to the city, Kanakapura Road is a preferred choice for those looking to balance urban convenience with natural surroundings. Land prices here range from ₹7,000–₹8,500 per sq. ft., catering to both mid-segment homebuyers and investors seeking long-term appreciation. - Electronic City

As one of Bengaluru’s original IT hubs, Electronic City continues to remain a strong value proposition. Supported by robust infrastructure, a thriving workforce, and high rental demand, land prices here range from ₹7,000–₹9,000 per sq. ft., offering affordability with assured demand.

4. Buying Plots in West Bengaluru – Emerging Corridors & Plot Investment

West Bengaluru is steadily asserting itself as a promising frontier for plot investments. Neighborhoods such as Kengeri, Kengeri Satellite Town, Rajarajeshwari Nagar (RR Nagar), and its surrounding layouts are drawing increasing attention. This growth is being driven by improved connectivity (road expansion, Metro plans), increasing social infrastructure, and better amenities. For investors, West Bengaluru offers a blend of comparatively lower entry prices than prime central zones, along with strong upside potential.

- Kengeri

Kengeri has emerged as a strong, value-driven market in West Bengaluru, supported by Metro connectivity and easy access via Mysore Road and NICE Road. Land rates in Kengeri Satellite Town range between ₹9,000–₹12,000 per sq. ft., depending on location and proximity to key infrastructure. - Rajarajeshwari Nagar (RR Nagar)

RR Nagar, with its well-planned layouts and strong civic infrastructure, reflects high valuation within West Bengaluru’s land market. The average land rates in Raja Rajeshwari Nagar, Bangalore are around ₹14,000-16,000 per sq. ft., with premium plots in prime layouts often commanding higher prices depending on location and frontage.

5. Budget-Friendly and Emerging Investment Pockets

For investors seeking high-growth potential at lower entry costs, Bengaluru’s peripheral areas offer compelling opportunities. These markets are still evolving but are strongly positioned to benefit from infrastructure-led growth in the near future.

- Hoskote

Hoskote has emerged as an attractive destination for first-time investors, thanks to its strategic location near upcoming industrial and logistics corridors. The average land rates in Hoskote, Bangalore are around ₹6,000 per sq. ft., making it a long-term value-driven investment option. - Chandapura

Located near Electronic City, Chandapura is steadily emerging as a preferred destination for affordable housing. The average land rates in Chandapura, Bangalore are around ₹4,000-4,500 per sq. ft., supported by its strategic location and ongoing infrastructure improvements.

6. Buying Plots in Bangalore’s Peripheral & Emerging Corridors – The Next Growth Belt

Beyond the established markets, Bengaluru’s peripheral corridors are shaping the city’s next growth story — where affordability meets opportunity and future-ready infrastructure fuels appreciation.

- Attibele

Positioned along the Bengaluru–Hosur Highway, Attibele is fast emerging as a plotted development hub driven by industrial growth and spillover from Electronic City and Sarjapur Road. With excellent access to NH-44, NICE Road, and the upcoming Peripheral Ring Road, Attibele offers affordability with promising long-term appreciation.

Average Land Rate: ₹4,500–₹6,000 per sq. ft.

Investment Insight: Ideal for first-time investors looking for gated plots with good appreciation prospects in the next 5–8 years. - Gunjur – Nerige (Off Sarjapur Road)

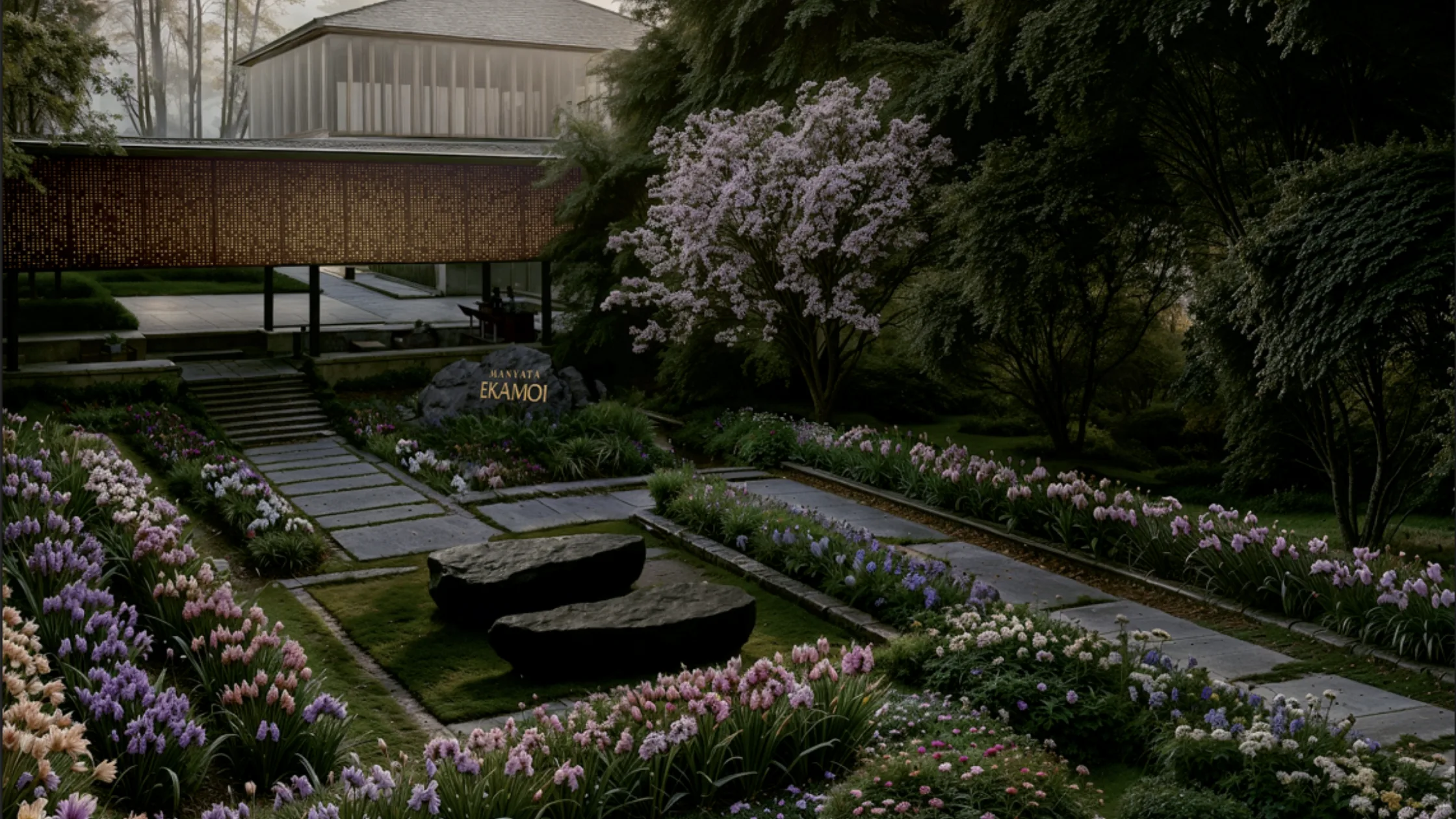

Located strategically between Sarjapur Road and Whitefield, the Gunjur–Nerige belt has become one of the most attractive emerging plotted investment corridors. Projects like Manyata Ekamoi and other villa plot developments are redefining the area’s skyline.

Average Land Rate: ₹7,000–₹10,000 per sq. ft.

Investment Insight: Backed by reputed developers and proximity to ORR, Varthur, and Bellandur, this corridor combines premium lifestyle with steady value appreciation. - Anekal

Anekal, in South Bengaluru’s outskirts, has gained investor traction due to its affordable land values and growing connectivity via NICE Road and the proposed Satellite Town Ring Road (STRR).

Average Land Rate: ₹3,500–₹5,000 per sq. ft.

Investment Insight: A long-term play for investors seeking large parcels of land with future development potential. - Hennur–Bagalur–Chikkajala Belt

Positioned between the Airport Road and North Bengaluru’s expanding business districts, this stretch benefits from the upcoming Peripheral Ring Road (PRR) and Airport Metro Line.

Average Land Rate: ₹4,500–₹8,000 per sq. ft.

Investment Insight: A fast-developing residential corridor where villa plots and gated layouts are witnessing steady demand from both NRIs and tech professionals. - Varthur – Dommasandra Extension

An extension of East Bengaluru’s IT influence, this corridor connects Whitefield, Sarjapur, and Gunjur seamlessly. With several schools, IT campuses, and new plotted layouts, it’s gaining popularity among buyers seeking a mix of urban convenience and open-space living.

Average Land Rate: ₹9,000–₹11,000 per sq. ft.

Investment Insight: Strong social infrastructure and developer-backed plots make it a mid-premium but safe investment bet.

Bengaluru’s Infrastructure Fueling Next-Gen Growth

Bengaluru’s meteoric rise as one of India’s most dynamic real estate markets is inextricably tied to its visionary infrastructure roadmap. The city’s leadership and urban planners have consistently emphasized mobility-driven development, recognizing that infrastructure is not just about easing commutes but about unlocking entire economic corridors. Each new expressway, metro line, and ring road is redrawing the city’s growth map, shifting demand from traditional centers to newly emerging hubs.

1. Namma Metro Expansions

The Namma Metro project stands as the backbone of Bengaluru’s urban mobility revolution. With the Blue Line Phase 2 and the upcoming Red Line Phase 3, the metro is poised to transform daily commuting patterns for millions of residents.

- Impact on Real Estate: Properties located within a 1–2 km radius of metro stations have historically appreciated by 20–50%, reflecting the premium placed on reliable, congestion-free connectivity.

- Investor Relevance: For plotted developments, proximity to metro stations has become a key differentiator, especially among working professionals seeking quick access to IT corridors and business hubs.

- Long-Term Outlook: Once fully operational, the network will rival that of other global metros, positioning Bengaluru as a truly world-class urban center.

2. Bangalore Suburban Rail Project (BSRP)

Often described as a game-changer for peripheral growth, the 148 km suburban rail network is set to connect the city’s outskirts with its economic core through four well-planned corridors.

- Impact on Commuting: The BSRP is expected to cut travel times drastically for daily commuters, offering an affordable, fast, and sustainable alternative to road travel.

- Real Estate Unlocking: Distant suburbs that were previously considered “too far” are suddenly viable for both residential and commercial development. This democratizes land investment opportunities, pushing plot appreciation into newer micro-markets.

- Strategic Advantage: For investors, BSRP corridors represent early-stage entry points that will witness exponential value growth once the system is operational.

3. Satellite Town Ring Road (STRR)

The STRR, spanning 280 km, is one of the most ambitious infrastructure projects designed to connect 12 satellite towns around Bengaluru.

- Macro Impact: By creating a continuous circular highway, STRR will decongest central Bengaluru, facilitate faster intercity movement, and stimulate the development of satellite urban clusters.

- Real Estate Boost: Vast tracts of currently underutilized land will become accessible, turning peripheral zones into investment hotspots. For plotted developments, this represents a once-in-a-cycle opportunity to secure land before mass appreciation begins.

- Economic Arc: The STRR is not just a transport link; it is a new economic belt that will host industries, logistics hubs, residential townships, and retail clusters.

4. Peripheral Ring Road (PRR) / Bangalore Business Corridor (BBC)

The long-anticipated revival of the 73 km Peripheral Ring Road — rebranded as the Bangalore Business Corridor (BBC) — is nothing short of transformative.

- Connectivity: Designed to link major arterial highways and radial roads, the PRR/BBC will enable smooth bypass traffic flow around the city.

- Business Decentralization: By reducing the dependency on central corridors, the PRR/BBC will shift commercial and residential activity to outer growth zones, balancing Bengaluru’s urban sprawl.

- Investor Opportunity: Land parcels along the BBC are expected to see dramatic appreciation, as both corporate campuses and premium residential projects gravitate towards this new business artery.

5. Underground Tunnel Roads

The proposed Hebbal to Central Silk Board tunnel epitomizes Bengaluru’s forward-looking approach to traffic management.

- Travel Time Reduction: This 16.7 km twin tunnel is projected to reduce commuting times from over 60 minutes to just 20 minutes — a 70% cut in travel duration.

- Value Enhancement: Properties and plotted communities located along the tunnel’s influence zone are likely to experience significant appreciation due to improved accessibility.

- Quality of Life: Beyond real estate, these tunnels will redefine the daily lifestyle of millions, creating a ripple effect of enhanced demand for well-connected residential developments.

Legal Documentation and Verification Before Buying Plots in Bangalore

When it comes to investing in plots, legal due diligence is not just a step — it is the cornerstone of the entire journey. The Indian real estate market, while full of opportunities, has also witnessed countless cases of fraud, disputed ownership, and irregular approvals.

The single biggest mistake an investor can make is skipping or rushing through legal verification. Ensuring that every document is in order is not simply a matter of compliance; it is your ultimate safeguard against financial loss and legal entanglement.

Essential Legal Documents Checklist before Buying Plots in Bangalore

A. Pre-Purchase Verification Documents

Before even considering a purchase, every buyer must ensure the property has clean and marketable title backed by the following documents:

- Title Deed (Mother Deed)

- The most important document in your verification process, the Mother Deed establishes the unbroken chain of ownership for the past 30 years.

- It should clearly reflect transfers, inheritances, or sales that have occurred without discrepancies.

- Any break or ambiguity in the ownership trail should be treated as a red flag until clarified legally.

- The most important document in your verification process, the Mother Deed establishes the unbroken chain of ownership for the past 30 years.

- Encumbrance Certificate (EC)

- This document reveals if the land has been used as collateral for a loan or if there are any pending mortgages, leases, or legal claims.

- Always request an EC for at least 13–30 years. A clean EC is non-negotiable for confirming that the property is free of financial or legal obligations.

- This document reveals if the land has been used as collateral for a loan or if there are any pending mortgages, leases, or legal claims.

- Khata Certificate (A-Khata)

- Issued by the municipal corporation (BBMP), the Khata establishes the property’s legal recognition in municipal records.

- An A-Khata property indicates compliance with all building norms and is legally transferable.

- Issued by the municipal corporation (BBMP), the Khata establishes the property’s legal recognition in municipal records.

- Property Tax Receipts

- Request the latest receipts of tax payments made to the municipal authority.

- This ensures that there are no dues, penalties, or arrears that could later become the buyer’s liability.

- Request the latest receipts of tax payments made to the municipal authority.

- Land Use Certificate (LUC)

- Land in Karnataka is classified into different categories (agricultural, residential, industrial, etc.).

- A Land Use Certificate verifies that the plot is legally classified as residential land and eligible for construction.

- Land in Karnataka is classified into different categories (agricultural, residential, industrial, etc.).

Read More: Major Victory for Bengaluru Property Owners: B-Khata to A-Khata Conversion Now Reality

B. Authority Approvals

Once pre-purchase documents are clear, the next step is to ensure the property has been approved by the correct planning authorities.

- Layout Approval

- Depending on the jurisdiction, the layout must be approved by either BDA, BMRDA, or DTCP.

- Only layouts sanctioned by these authorities ensure compliance with zoning and development regulations.

- Depending on the jurisdiction, the layout must be approved by either BDA, BMRDA, or DTCP.

- RERA Registration

- If the plot is part of a developer’s project, RERA registration is mandatory.

- Karnataka RERA ensures that developers disclose all project details, approvals, timelines, and commitments transparently.

- If the plot is part of a developer’s project, RERA registration is mandatory.

- Conversion Certificate (DC Conversion)

- If the land was originally agricultural, it must be legally converted for residential use through a Deputy Commissioner’s Conversion Certificate.

- Any plot without DC conversion is illegal to build on, regardless of developer assurances.

- If the land was originally agricultural, it must be legally converted for residential use through a Deputy Commissioner’s Conversion Certificate.

- NOC (No-Objection Certificates)

- Depending on location and project size, approvals may be required from:

- Pollution Control Board

- Fire and Safety Department

- Electricity Supply Authority

- Water and Sewage Board

- Airport Authority of India (if near flight paths)

- Pollution Control Board

- Each NOC adds another layer of assurance that the land is free from restrictions.

- Depending on location and project size, approvals may be required from:

C. Financial and Legal Clearances

- No Pending Legal Disputes

- Engage a real estate lawyer to verify that there are no ongoing litigations, disputes, or family settlements tied to the land.

- Even minor cases can delay or jeopardize construction and resale.

- Engage a real estate lawyer to verify that there are no ongoing litigations, disputes, or family settlements tied to the land.

- Power of Attorney (PoA) Validation

- If the seller is acting through a Power of Attorney, ensure it is valid, notarized, and registered with the Sub-Registrar.

- Fake or expired PoAs are a common source of fraudulent transactions.

- If the seller is acting through a Power of Attorney, ensure it is valid, notarized, and registered with the Sub-Registrar.

RERA Verification Process before Buying Plots in Bangalore

The Real Estate Regulatory Authority (RERA) is your best ally in due diligence. It ensures transparency, accountability, and consumer protection in real estate.

- Step 1: Visit the Official Karnataka RERA website

- Step 2: Navigate to Projects → Registered Projects

- Step 3: Search using the project name, developer’s name, or unique RERA ID

- Step 4: Verify all details such as approvals, timelines, and land status

- Step 5: Cross-check the RERA number against the marketing brochures and advertisements.

Red Flags to Avoid While Buying Plots in Bangalore

- Projects being marketed without a valid RERA registration.

- Mismatched layout plans (brochures vs. approved authority plans).

- Unregistered developers or agents making false claims.

- Sellers unwilling to share original documents.

- Projects with pending litigation or unclear ownership history.

Physical and Technical Evaluation

Documents can’t tell the whole story. A physical site visit is non-negotiable.

Site Inspection Checklist

- Infrastructure Assessment:

Check for the availability of essential infrastructure: road connectivity, electricity, water supply, and sewage systems. - Physical Plot Evaluation:

- Confirm that the plot’s dimensions and boundaries on the ground match the survey records.

- Assess the soil quality and topography. Is it on a slope? Is it prone to waterlogging?

- Check for any signs of encroachment.

- Neighborhood Analysis:

- Assess the proximity to schools, hospitals, and shopping centers.

- Check for public transportation connectivity.

- Evaluate the security and safety of the area.

Financial Planning and Investment Analysis for Plots in Bangalore

A smart investment starts with a clear financial plan.

Budget Calculation Framework

- Primary Costs: Plot purchase price, stamp duty 5% for properties above ₹45 lakh (Times of India), registration charges 2% of property value, and legal fees.

- Additional Expenses: Account for brokerage, survey charges, utility connection fees, and development charges.

Financing Options and Plot Loan Details

Plot loans are a popular option. They have different terms compared to home loans.

- Interest Rates: Plot loan interest rates in India typically start from 8.0% per annum onwards, depending on the lender and applicant profile.

- Loan-to-Value (LTV) Ratio: Lenders generally finance up to 75%–80% of the plot’s value, based on the applicant’s creditworthiness and other factors. (ET)

- Top Lenders: Leading providers of plot loans include HDFC, ICICI Bank, SBI, Axis Bank, and Bajaj Housing Finance.

- Eligibility: Lenders typically prefer applicants with a good CBIL score of 750+, a stable income, and a manageable debt-to-income ratio. (ET)

Registration and Transaction Process

This is the final hurdle to becoming a proud plot owner.

Step-by-Step Registration Process

- Pre-Registration Preparation: Your lawyer will draft the sale deed on stamp paper, and you will pay the stamp duty and registration fees.

- Registration Day Process: Both the buyer and seller must visit the Sub-Registrar’s Office with all original documents. The Sub-Registrar will verify the documents, and both parties will undergo biometric verification and sign the deed.

- Post-Registration Steps: After the deed is registered, apply for the mutation of the property and update the Khata records.

Real Estate Investment Strategy and ROI Analysis

Investment Horizon Planning

- Short-term (1-3 years): High capital appreciation potential in fast-developing corridors.

- Medium-term (3-7 years): Optimal for riding the wave of infrastructure-driven growth.

- Long-term (7+ years): Significant appreciation potential, ideal for legacy building.

Risk Assessment and Mitigation

Common Pitfalls to Avoid:

- Legal Risks: Buying plots with unclear titles or without RERA verification.

- Financial Risks: Not accounting for all costs or over-leveraging with high EMIs.

- Technical Risks: Ignoring soil quality, topography, or flood-prone areas.

Risk Mitigation Strategies:

- Always engage a qualified legal expert.

- Conduct independent due diligence on all approvals.

- Factor in infrastructure development timelines to manage expectations.

- Maintain a financial buffer for unexpected expenses.

Future Outlook and Trends

2025-2030 Growth Projections:

The period between 2025 and 2030 is set to redefine the real estate landscape, particularly in Bengaluru and its surrounding growth corridors. What lies ahead is not merely incremental appreciation but a transformational shift in how and where people choose to live and invest. Infrastructure is at the center of this change. With projects like the Satellite Town Ring Road (STRR), the Peripheral Ring Road (PRR), and upcoming metro expansions, suburban belts such as Devanahalli, Hoskote, Malur, Chandapura, Anekal, Attibele Nelamangala, and Sarjapur are poised to emerge as tomorrow’s urban hubs. These regions, once considered too far from the city, are rapidly becoming highly connected, offering investors and homeowners the perfect blend of accessibility and affordability.

This growth is being fueled further by the expansion of Bengaluru’s technology and startup ecosystem. As companies establish satellite offices and remote hubs outside traditional IT corridors, real estate demand is spreading outward, ensuring that both plotted developments and gated villa communities in suburban zones remain in high demand. At the same time, demographic shifts are reshaping buyer behavior. Millennials and Gen Z, who are entering their prime home-buying years, are seeking larger homes, private plots, and lifestyle-centric communities that allow them to balance work, leisure, and family life. Unlike apartments, which often depreciate, land continues to appreciate in value, making plotted developments one of the most secure and profitable asset classes for this new generation of buyers.

The regulatory environment is also playing a decisive role in strengthening the market. With stricter RERA norms and digitization of property records, transparency has improved significantly, giving investors and first-time buyers the confidence to participate in the market without fear of hidden risks. This regulatory clarity, combined with Bengaluru’s strong global connectivity through Kempegowda International Airport, is expected to attract a surge of NRI investments. Favorable exchange rates and rising trust in India’s regulatory framework make plotted developments a particularly attractive option for global investors seeking stable long-term returns.

Another important trend shaping the next five years is the increasing focus on sustainability and smart living. Developers are responding to growing buyer expectations by integrating eco-friendly practices such as rainwater harvesting, solar-powered amenities, and sustainable layouts. These features are no longer seen as optional add-ons but as decisive factors influencing purchase decisions. With plot prices currently ranging from ₹3,000 to ₹12,000 per sq. ft., experts predict steady appreciation across all suburban belts, with some prime zones near STRR and the airport corridor expected to double in value by 2030. Early investors, especially those who secure plots in pre-developed or early-stage villa communities, are best positioned to reap the benefits of this appreciation.

By the end of this decade, Bengaluru’s real estate market will evolve from a city-centric model into a multi-nodal ecosystem, where suburban growth corridors rival or even surpass the traditional city center in terms of desirability and returns. The combination of robust infrastructure, demographic shifts, regulatory transparency, and sustained economic growth ensures that real estate—particularly land and plotted developments—will remain one of the most resilient and rewarding investment avenues in India. The future, quite simply, belongs to those who act early, stay informed, and make smart choices.

Read More: Green Real Estate Revolution: Your Gateway to Sustainable Wealth in India’s Booming Market

Conclusion

Buying a plot in Bangalore in 2025 is a powerful move, but it requires meticulous attention to detail. This comprehensive checklist is your roadmap to a secure investment. By engaging professional help, conducting thorough due diligence, and understanding the market dynamics, you can avoid common pitfalls and secure a piece of this vibrant city’s future.

Houzbay Curated Projects to Buy Plots in Bangalore

Houzbay handpicks the most promising real estate opportunities in Bangalore, giving you access to projects with high growth potential and strong returns. Your trusted partner and portfolio manager, Houzbay helps you invest wisely, ensuring every investment works seamlessly towards your long-term goals.

Manyata Ekamoi – Luxury Villa Plots for Sale in Off Sarjapur, Bangalore

Manyata Ekamoi is an exclusive villa plotted development located off Sarjapur Road (Gunjur – Nerige area) by Manyata Developers. Spanning across approximately 20.37 acres with around 189 premium plots, the project is designed to offer a perfect balance of nature and modern living. With lush green landscapes, wide roads, underground utilities, and premium infrastructure, Manyata Ekamoi promises a serene yet well-connected lifestyle. It’s an ideal choice for homebuyers and investors seeking luxury plotted development in Bengaluru’s most sought-after growth corridor.

🌿 Project Highlights

Developer: Manyata Developers

Total Area: 20.37 Acres

Project Type: Premium Villa Plotted Development

Total Plots: ~189

Plot Sizes: Ranging from 1500 sq. ft. onwards

Location: Off Sarjapur Road, Gunjur – Nerige area, Bengaluru

Infrastructure: Wide asphalted roads, underground cabling, water and sewage network

Green Ratio: High open space with landscaped parks and tree-lined avenues

Amenities: Clubhouse, walking trails, children’s play area, and multipurpose courts

Connectivity: Close to ORR, Whitefield, Varthur, and Carmelaram Railway Station

Investment Potential: Located in a high-growth residential and IT corridor

Know More: Manyata Ekamoi Luxury Villa Plot: Location, Amenities, Investment Guide

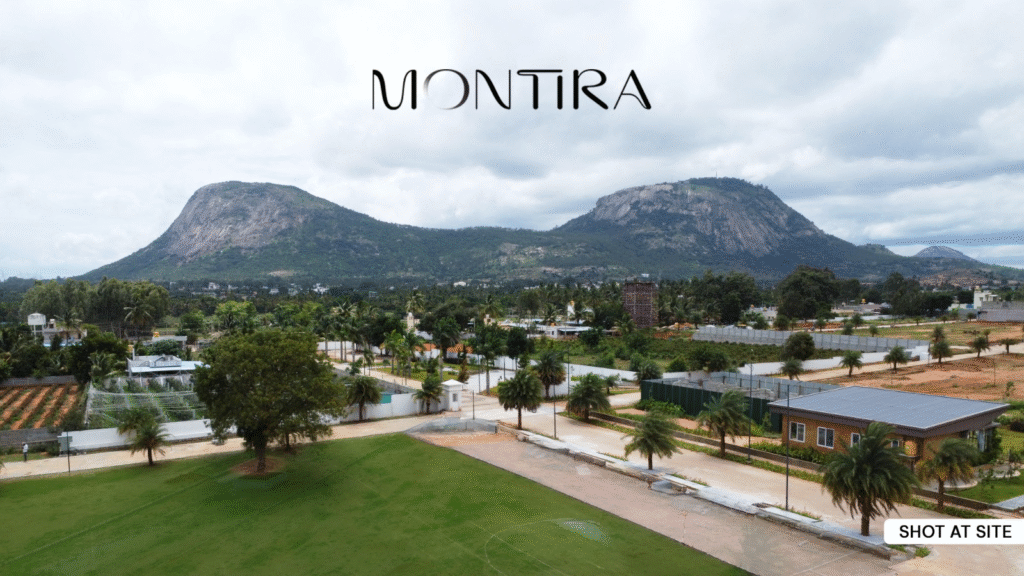

Montira By Rare Earth – Plots for Sale in Bangalore -Nandi Hills

Project Highlights:

- A Palmeraie-themed gated community spread across 14.34 acres.

- 116 premium villa plots in the foothills of Nandi Hills.

- An 18,000 sq. ft. clubhouse featuring 27+ amenities.

- RERA Approved.

- Just 5 minutes from JW Marriott, 12 minutes from the STRR and 25 minutes from Bangalore International Airport.

If you’d like to visit this project and learn more, please click on this link: Montira

Read More: Montira, Nandi Hills – A Complete Guide to Buying Your Plot in Bangalore

Sapling by Saibya – Plots for Sale in Bangalore, Nandi Hills-Doddaballapur Road

Project Highlights:

- Located on Nandi Hills-Doddaballapur Road.

- 14.33 acres of luxury estate farm plots.

- 54 exclusive units.

- 15 minutes from the STRR and 20 minutes from the Foxconn Apple Project.

Interested in an estate farm plot? Please click on this link: Saibya Sapling

Magical Springs by SID Infra – Luxury Villa Plots in Bangalore, Off IVC Road

Project Highlights:

- A Mediterranean-themed luxury villa plot community spread across 34 acres.

- Located off IVC Road, Bengaluru.

- RERA Approved.

- Over 30 lifestyle amenities, including a Reflexology Pathway, Futsal Court, Butterfly Park, Tree House, and Vineyard.

- Just 10 minutes from Bangalore International Airport.

- Seamless access to STRR (11 min), and the Airport Metro & Devanahalli SEZ.

Ready to experience this magical community? Click Magical Springs to explore the villa plot.

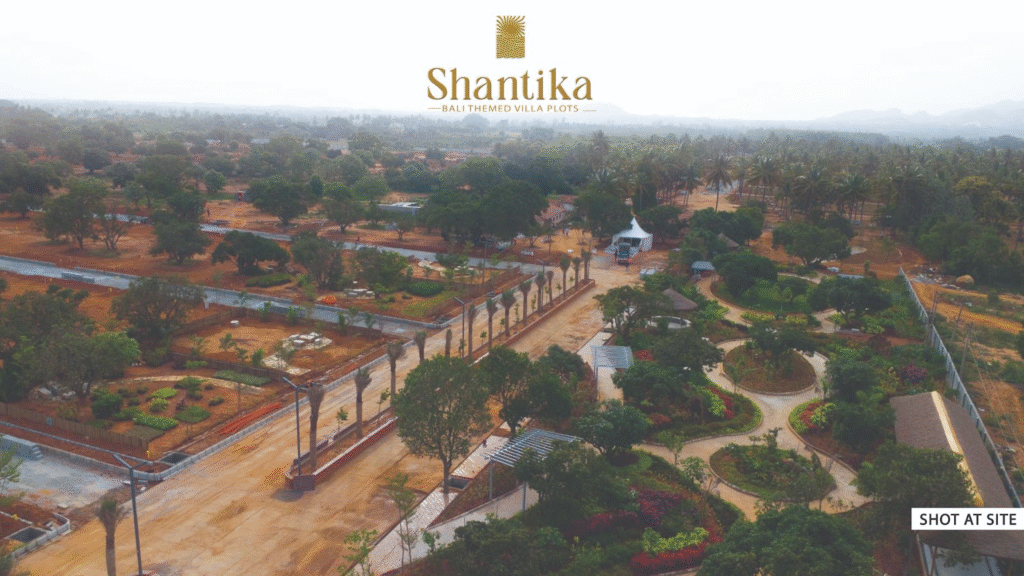

Shantika by Sannidhi – Luxury Villa Plots in Bangalore, Malur, off Hoskote Road

Project Highlights:

- A Bali-themed luxury villa plot community spread across 53 acres.

- Located in Malur, off Hoskote Road, East Bangalore.

- RERA Approved.

- A 27,000 sq. ft. clubhouse with world-class amenities.

- Whitefield, ITPL & KIADB are less than an hour away.

- Just 25 minutes from the upcoming Hoskote Metro and under 2 km from the STRR & Bangalore-Chennai Expressway.

Curious to know more about Shantika? Please Visit: Shantika By Sannidhi

Frequently Asked Questions (FAQs):

2. What documents are mandatory?

The Title Deed, Encumbrance Certificate (EC), and Khata Certificate are non-negotiable. RERA registration is also mandatory for new plotted developments.

3. What is the current price range?

Prices vary from ₹3000/sq ft in budget-friendly areas like Hoskote to over ₹12,000/sq ft in prime locations.

4. Can I get a loan to buy a plot?

Yes, most banks offer plot loans with interest rates starting from around 8.0%. The LTV ratio is typically up to 75-80% of the plot's value.

5. What are the total costs involved?

Besides the plot price, factor in stamp duty, registration charges, legal fees, brokerage, and utility connection fees.

6. How do I verify if a plot is RERA registered?

Visit the Karnataka RERA website, navigate to "Registered Projects," and search using the project name or RERA ID.

7. Which are the best areas to buy plots in Bangalore right now?

Top-performing areas include North Bengaluru (Devanahalli, Hebbal, Yelahanka), East Bengaluru (Whitefield, Sarjapur Road, Gunjur–Nerige), and emerging belts like Attibele, Bagalur, and Hoskote. These regions combine infrastructure, employment access, and price growth potential.

8. Is buying a plot in Bangalore a good investment in 2025–26?

Yes. With major infrastructure projects like the Peripheral Ring Road (PRR), Satellite Town Ring Road (STRR), and Namma Metro expansion, land in Bangalore is set for strong appreciation. Plotted developments in emerging zones such as Sarjapur Road, Devanahalli, and Attibele are offering high long-term ROI.

9. What is the average price of plots in Bangalore in 2025?

Plot prices in Bangalore vary by location:

Premium areas: ₹12,000–₹20,000 per sq. ft. (Whitefield, Hebbal, RR Nagar)

Mid-segment: ₹6,000–₹10,000 per sq. ft. (Sarjapur, Devanahalli, Yelahanka)

Emerging pockets: ₹3,500–₹6,000 per sq. ft. (Attibele, Anekal, Hoskote)

10. What are the key factors to consider before buying a plot in Bangalore?

Check for clear title, developer credibility, BDA/BMRDA approval, and proximity to key infrastructure. Also, ensure basic amenities like roads, drainage, and water supply are already in place before purchase.

11. How does buying a plot compare to buying an apartment in Bangalore?

Plots offer greater flexibility, appreciation, and lower maintenance, while apartments provide immediate livability and rental income. For long-term investors, plots typically deliver better capital growth over time.

12. What documents are required for plot registration in Bangalore?

You’ll need:

Sale Deed

Encumbrance Certificate (EC)

Property Tax Receipts

Khata Certificate and Extract

Identity proof & PAN card

Registration is done at the sub-registrar office where the property is located.