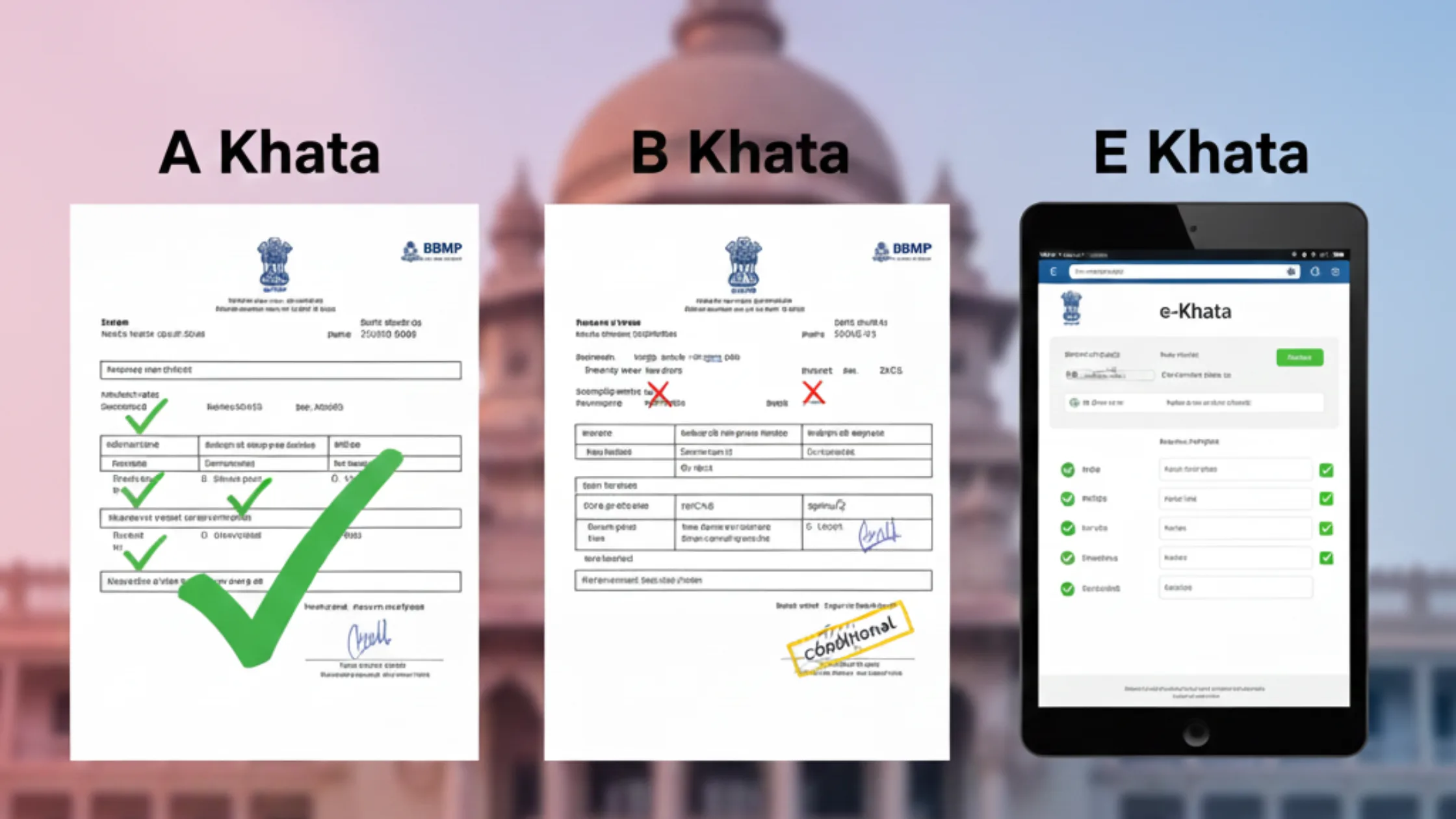

A-Khata vs B-Khata vs E-Khata – What Is the Difference in Bangalore?

In Bangalore, property ownership does not begin with possession; it begins with permission. Before a bank approves your loan, before BBMP sanctions a building plan, and long before resale enters the picture, one document quietly decides your property’s fate: the Khata. Yet for most buyers, terms like A-Khata, B-Khata, and E-Khata remain confusing and misunderstood. This guide on A-Khata vs B-Khata vs E-Khata in Bangalore breaks down what each Khata truly represents, how it affects legality and risk, and which option protects your investment in Karnataka.

A Khata Meaning

A-Khata means a legally compliant property record issued by the Bruhat Bengaluru Mahanagara Palike (BBMP). It certifies that a property in Bangalore fully adheres to all applicable laws, including zoning regulations, building bylaws, land-use norms, and tax requirements.

In simple terms, A-Khata confirms that the property is officially recognised by BBMP for taxation and civic administration. The property has been assessed for property tax, the land use is approved (residential or commercial, as applicable), and the development complies with the city’s planning framework.

When buyers ask what A Khata in Bangalore is, the most accurate answer is this: A Khata represents the highest level of legal clarity and compliance for urban properties within BBMP limits. It is not just a tax receipt but a validation of legality.

Benefits of A-Khata

Owning an A-Khata property offers several practical and financial advantages, especially in a market as regulation-heavy as Bangalore.

1. Eligible for Bank Loans

One of the biggest advantages of A-Khata is loan eligibility. Most nationalised banks, private banks, and housing finance companies approve home loans only for A-Khata properties. Since the property meets BBMP norms, lenders face lower legal risk, making financing smoother and faster.

2. Building Plan Approvals Allowed

With A-Khata, you can legally apply for:

- Building plan sanctions

- Occupancy Certificate (OC)

- Completion Certificate (CC)

This is critical for both plot buyers planning construction and homebuyers purchasing independent houses. Without A-Khata, BBMP approvals become nearly impossible.

3. Hassle-Free Resale and Mutation

A-Khata properties are easier to sell because:

- Buyers face fewer legal red flags

- Title verification is simpler

- Khata transfer (mutation) is faster

In resale scenarios, A-Khata properties command higher buyer trust and better market value compared to B-Khata properties.

4. Higher Market Value & Demand

Properties with A-Khata status typically enjoy:

- Better price appreciation

- Higher demand from end-users

- Faster liquidity

This is one of the key reasons why the difference between A Khata and B Khata has a direct impact on pricing in Bangalore’s real estate market.

5. Preferred by NRIs and Long-Term Investors

NRIs, in particular, prefer A-Khata properties because they reduce:

- Legal complications

- Approval delays

- Long-term compliance risks

For buyers who are not physically present in India, A-Khata offers peace of mind.

Who Should Buy A Khata Properties?

1. End-Users

A-Khata is not just a safe option; it is the recommended option for certain buyer profiles.

If you are buying a plot or house to:

- Build immediately

- Move in

- Apply for utilities and approvals

then A-Khata is the safest choice. It ensures uninterrupted access to BBMP services and legal certainty for long-term living.

2. NRIs

For NRIs looking to invest or settle in Bangalore, A-Khata properties offer:

- Clear documentation

- Easy resale in the future

- Fewer compliance follow-ups

This is why most advisory firms strongly recommend A-Khata for overseas buyers.

3. Buyers Seeking Low Legal Risk

If your priority is risk minimisation, A-Khata is ideal. It eliminates common issues such as:

- Zoning violations

- Tax irregularities

- Approval limitations

While A-Khata properties may come at a premium, the added cost often translates into long-term security and smoother ownership.A-Khata is the gold standard of property ownership in Bangalore. It signals full compliance, legal safety, and long-term value. For buyers who want clarity, credibility, and confidence, A-Khata remains the most secure option in the city’s evolving real estate landscape.

B Khata Meaning

B Khata means a property record maintained by the Bruhat Bengaluru Mahanagara Palike (BBMP) for properties that do not fully comply with planning, zoning, or approval norms, but are still registered in the tax system. In other words, the BBMP acknowledges the existence of the property only for property tax collection purposes, not as a fully legal or approved development.

Many buyers misunderstand this point. B-Khata does not mean the property is illegal by default. Instead, it indicates that the property has one or more deviations, such as:

- Built on revenue land, not fully converted

- Layout without proper approvals

- Violations of zoning or planning regulations

- Excess construction beyond sanctioned limits

Because of these gaps, the property is separated from A-Khata and placed under B-Khata records.

Limitations of B-Khata

While B-Khata properties are common in Bangalore, especially in older layouts and outskirts, they come with serious limitations that buyers must understand clearly.

1. No Building Plan Approval

BBMP does not issue building plan approvals for B-Khata properties. This makes B-Khata extremely risky for:

- Plot buyers planning construction

- Buyers intending major renovations or reconstruction

Without approval, construction can attract notices, penalties, or even demolition orders in extreme cases.

2. Loan Restrictions

Most banks and housing finance companies are hesitant to offer loans for B-Khata properties. Even if loans are approved, they usually come with:

- Lower loan-to-value ratios

- Higher scrutiny

- Additional legal documentation

This directly affects affordability and resale demand.

3. Resale Challenges

Reselling a B-Khata property is harder because:

- Many buyers avoid legal uncertainty

- Banks hesitate to finance end-buyers

- Price negotiations often favour buyers

This is a key reason why the difference between A Khata and B Khata has a visible impact on market value.

Is B-Khata Legal or Illegal?

This is one of the most frequently asked questions: Can I buy B-Khata property in Bangalore?

The correct answer lies in understanding legality vs compliance.

- B-Khata properties are not illegal assets

- However, they are not fully compliant with BBMP regulations

B-Khata may be considered in limited scenarios:

- Vacant plots in developing zones where regularisation is expected

- Long-term investors are willing to wait for future approvals or policy changes

However, B-Khata is not advisable for immediate construction or end-use housing. Buyers must enter such transactions only after detailed legal due diligence.

E Khata Meaning

E Khata means a digital version of the Khata record, introduced by BBMP as part of its property digitisation initiative. Instead of a physical paper certificate, property details are now stored and issued electronically through BBMP’s online system.

An important clarification: E Khata is not a new Khata category. It applies to both A-Khata and B-Khata properties. The underlying legal status of the property remains unchanged.

This directly addresses the common query: Is E Khata valid in Bangalore?

Yes, it is valid—but only as a format, not a legal upgrade.

E-Khata vs Physical Khata

Many buyers assume E-Khata replaces A-Khata or B-Khata. That is incorrect.

- E-Khata is a digital format

- A-Khata or B-Khata is the legal classification

So, E-Khata does not make a B-Khata property legal. This is a critical point that sellers often miscommunicate. A B-Khata property with E-Khata remains B-Khata, with the same restrictions on loans, approvals, and resale.

In short:

- A-Khata + E-Khata = Legally compliant, digitally recorded property

- B-Khata + E-Khata = Non-compliant property, digitally recorded

Who Needs E Khata in Bangalore?

E-Khata is increasingly becoming mandatory in practical scenarios:

New Buyers

Most new registrations and property records are now issued in digital format, making E-Khata the default.

Mutation & Transfer Cases

When a property changes ownership due to a sale, inheritance, or gift deed, BBMP updates records electronically through E-Khata.

Property Tax Updates

E-Khata simplifies:

- Online tax payments

- Corrections in the owner details

- Address or usage updates

“E-Khata improves transparency and efficiency, but it does not change legality. Buyers must always verify whether the property is A-Khata or B-Khata, regardless of whether the Khata is issued digitally or physically.”

A Khata vs B Khata vs E Khata

| Parameter | A-Khata | B-Khata | E-Khata |

| Legal compliance | ✅ Fully compliant with BBMP rules and planning norms | ⚠️ Partially compliant / deviations exist | Depends on the underlying Khata (A or B) |

| Property tax status | ✅ Regularly assessed and paid | ✅ Assessed only for tax purposes | ✅ Digitally recorded tax status |

| Bank loan eligibility | ✅ Allowed by most banks & HFCs | ❌ Mostly restricted / case-specific | Depends on whether A-Khata or B-Khata |

| Building plan approval | ✅ Permitted by BBMP | ❌ Not permitted | Depends on the base Khata type |

| Construction allowed | ✅ Yes, with approvals | ❌ High risk / not recommended | Depends on the base Khata type |

| Resale value & demand | High demand, better appreciation | Lower demand, discounted pricing | Depends on A or B classification |

| Mutation & transfer ease | Easy and straightforward | Time-consuming, scrutiny involved | Easier due to the digital process |

| Risk level for buyers | Low | High | Depends on A or B Khata |

| Preferred buyer type | End-users, NRIs, low-risk buyers | Speculative/long-term investors | New buyers & recent transfers |

| Format of record | Physical Khata certificate | Physical Khata certificate | ✅ Fully digital (online record) |

Which Khata Is Safe to Buy in Bangalore?

In Bangalore, Khata safety is not subjective—it is determined by compliance, approvals, and lender acceptance. While all three terms are commonly used, only one offers complete security to buyers.

Safest Option → A-Khata

A-Khata is the safest Khata to buy in Bangalore because it confirms full compliance with BBMP regulations. It allows bank loans, building approvals, legal construction, and smooth resale. For end-users, families, and NRIs, A-Khata eliminates uncertainty and long-term risk.

Conditional Option → B-Khata (with Conversion Potential)

B-Khata can be considered only when there is a clear, realistic path to A-Khata conversion. This applies mainly to vacant plots or older properties in zones where regularisation is permitted. Without conversion potential, B-Khata carries higher legal and financial risk.

Format Only → E-Khata Is Not a Khata Type

E-Khata does not determine safety. It is only a digital record format. A property with E-Khata can still be risky if it remains B-Khata at its core.

Simple Buyer Flow

- Need a home loan or planning to build now? → A-Khata only

- Long-term investor with legal guidance and patience? → B-Khata (conditional)

- Property marketed as “safe” only due to E-Khata? → Verify Khata type immediately

Can B-Khata Be Converted to A-Khata?

Yes, B-Khata can be converted to A-Khata, but only when strict conditions are met. Conversion is a compliance-driven process, not an entitlement.

Eligibility Criteria

Zoning Compliance – The property must fall within an approved residential or commercial zone. Green-belt, agricultural, or heavily violated layouts are typically ineligible.

Betterment Charges – The property owner must pay betterment charges levied by Bruhat Bengaluru Mahanagara Palike (BBMP). These charges compensate for past non-compliance.

Property Tax Clearance – All pending property taxes, penalties, and discrepancies must be cleared before applying for conversion.

Step-by-Step Conversion Process

- Document Preparation – Sale deed, encumbrance certificate, existing Khata, tax receipts

- Zoning Verification – Confirm land-use compliance

- Payment of Betterment Charges – Amount varies by location and size

- Application Submission – File request with BBMP

- Verification & Approval – Site inspection and record checks

Timeframe: Typically 3–6 months

Cost Estimate: Varies widely; buyers should plan conservatively

Khata & Bank Loans: What Lenders Accept

Banks consider Khata status a primary risk filter when approving property loans.

A-Khata Properties

- Accepted by most banks and housing finance companies

- Higher loan eligibility

- Faster approvals

B-Khata Properties

- Commonly rejected

- Limited loan options for vacant plots only

- Lower loan amounts and stricter scrutiny

Why Banks Reject B-Khata

- No building approval eligibility

- Zoning or layout violations

- Weak resale security

NRI Loan Considerations

NRIs face tighter checks. Most lenders insist on A-Khata only, making it the safest and often mandatory option for overseas buyers.

Common Buyer Mistakes to Avoid

Even well-informed buyers in Bangalore make costly mistakes when it comes to Khata verification. Most issues arise not from fraud, but from assumptions and half-knowledge. Understanding these common errors can protect your investment and prevent long-term legal stress.

1. Confusing E-Khata as Legal Approval

One of the biggest misconceptions today is treating E-Khata as proof of legality. Many buyers assume that if a property has E-Khata, it is automatically approved. This is incorrect. E-Khata only means the record is digital. If the underlying classification is B-Khata, the property remains non-compliant, regardless of the format.

2. Buying B-Khata for End-Use Housing

B-Khata properties are often priced attractively, which tempts end-users. However, buying B-Khata for immediate construction or living is risky. Without building plan approval, buyers may face notices, penalties, or stalled construction. B-Khata is suitable only for conditional, long-term investment—not for families planning to build or occupy.

3. Skipping Khata Verification Before Purchase

Many buyers focus on the sale deeds and overlook the Khata verification. This can lead to surprises later, especially during loan applications or resale. Khata status should be checked before signing the agreement, not after registration. Relying on seller assurances alone is a common and avoidable mistake.

4. Relying Only on Property Tax Receipts

Paying property tax does not make a property legal. BBMP collects tax even on non-compliant properties. Tax receipts confirm payment, not compliance. Buyers should always distinguish between tax recognition and legal approval.

What is happening in Bangalore

Bangalore’s real estate ecosystem has evolved unevenly, which directly impacts Khata classification. Understanding city-specific nuances gives buyers a strong advantage.

BBMP Jurisdiction Impact

Properties within Bruhat Bengaluru Mahanagara Palike (BBMP) limits follow stricter Khata rules compared to peripheral areas governed earlier by village panchayats or planning authorities. Many older properties were absorbed into the BBMP without full compliance, leading to widespread B-Khata records.

Old Layouts vs New Developments

Older layouts often carry legacy issues such as:

- Incomplete approvals

- Road width deviations

- Zoning mismatches

Newer developments, especially those launched after stricter planning controls, are more likely to qualify for A-Khata. Buyers should not assume age equals safety; verification is essential.

Plot vs Apartment Khata Nuances

Khata rules differ slightly based on property type:

- Plots: Higher risk of zoning and layout issues, especially in the outskirts

- Apartments: Dependent on project approvals, OC, and developer compliance

A single missing approval can affect Khata status across all units in an apartment project.

Digitisation & Compliance Trends

With BBMP accelerating digitisation through E-Khata, transparency is improving. However, digitisation does not override compliance. Future policy trends indicate stricter enforcement, making legal clarity today more valuable than speculative regularisation tomorrow.

FAQs for A-Khata vs B-Khata vs E-Khata

Is E-Khata mandatory in Bangalore?

E-Khata is not legally mandatory, but it is increasingly becoming the default format used by Bruhat Bengaluru Mahanagara Palike. Most new Khata issuances, mutations, and property tax updates are now done digitally. However, E-Khata does not replace the need to verify whether a property is A-Khata or B-Khata.

Is E-Khata better than A-Khata?

E-Khata is not better than A-Khata because they represent different things. A-Khata defines the legal status of a property, while E-Khata only defines the format of the record. A property with E-Khata can still be B-Khata and carry the same legal risks.

Can I buy a B-Khata property safely in Bangalore?

You can buy a B-Khata property safely only under specific conditions. It may be suitable for long-term investors if the property has clear potential for conversion to A-Khata. For end-use, immediate construction, or buyers seeking low legal risk, B-Khata properties are generally not advisable.

Will banks give loans for B-Khata properties in Bangalore?

Most banks do not prefer B-Khata properties for home loans. Some lenders may consider limited funding for vacant plots under strict conditions, but loan eligibility is usually lower, and approval timelines are longer. A-Khata properties are far more likely to receive bank loan approval.

Does E-Khata mean the property is legal in Bangalore?

No, E-Khata does not mean the property is legal. It only confirms that the Khata record is available in digital format. The legality of a property depends entirely on whether it is classified as A-Khata or B-Khata.

How long does it take to convert B-Khata to A-Khata in Bangalore?

Converting B-Khata to A-Khata usually takes between three to six months. The timeline depends on zoning compliance, payment of betterment charges, document verification, and BBMP approvals. Properties with planning violations or tax issues may take longer.

Which Khata is best for NRIs buying property in Bangalore?

A-Khata is the best and safest option for NRIs buying property in Bangalore. Most banks insist on A-Khata for NRI home loans, and it reduces legal follow-ups when the buyer is based overseas. B-Khata properties are typically avoided by NRIs due to higher compliance risk.

Is A-Khata required for resale of property in Bangalore?

A-Khata is not legally mandatory for resale, but it makes selling significantly easier. Buyers prefer A-Khata properties because they qualify for bank loans and have fewer legal hurdles. As a result, A-Khata properties usually achieve better resale value and faster transactions.

How can I check Khata status online in Bangalore?

You can check Khata status online through BBMP’s official property tax or Khata portals using the property ID or assessment number. The online record will indicate whether the property is A-Khata or B-Khata and whether it is issued as E-Khata. Always verify online details with official documents before purchasing.