What Is B-Khata – Meaning, Benefits & Why It Matters for Property Buyers in Bangalore

In Bangalore’s fast-evolving real estate landscape, B-Khata sits at the intersection of demand and doubt. Buyers hear the term early, developers confront it often, and banks scrutinize it closely. To understand what B-Khata is, you need to look beyond definitions and into why it exists, how it impacts trust, and where it fits in a city shaped by rapid growth and fragmented planning. This is not just a buyer issue—it’s a strategic reality developers must navigate every day.

What does B-Khata Mean?

So, what is B-Khata in practical terms?

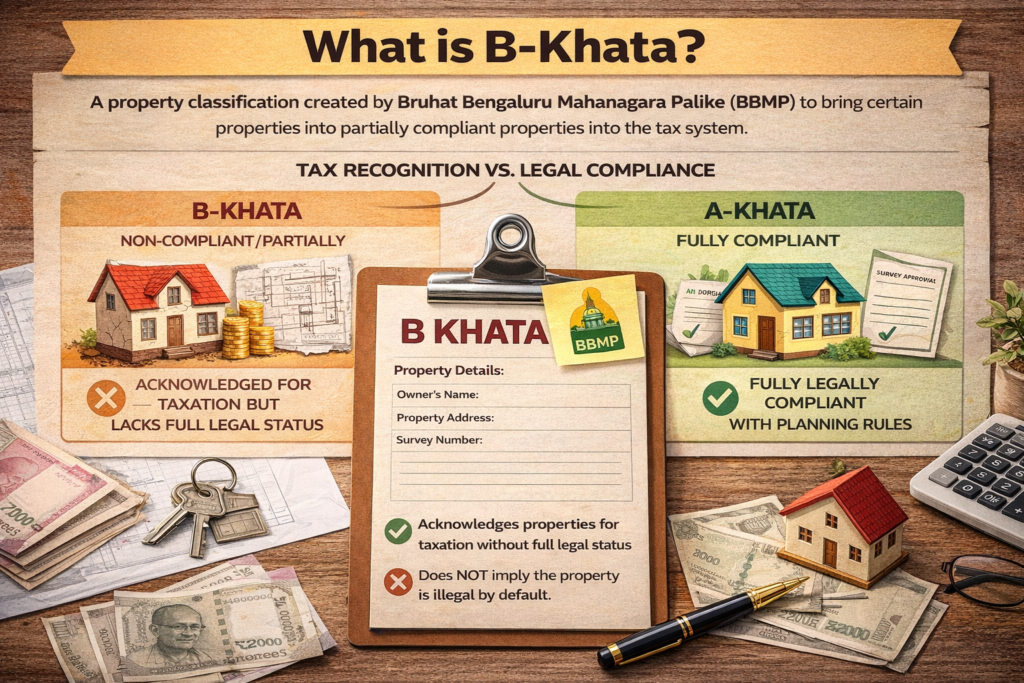

B-Khata is a property classification created by Bruhat Bengaluru Mahanagara Palike (BBMP) to bring certain non-compliant or partially compliant properties into the tax net. The intent was pragmatic: enable property tax collection even when full legal approvals were missing.

This distinction is crucial. B-Khata’s meaning does not imply illegality by default. Instead, it indicates that while the property is recognised for taxation, it lacks full legal recognition under planning or land-use norms.

That’s why conversations around what is A Khata and B-Khata often confuse buyers—the difference lies in compliance, not ownership alone.

What B-Khata Allows vs What It Restricts

Understanding what B-Khata allows versus what it restricts helps set realistic expectations.

What B-Khata allows:

- Property tax payment to BBMP

- Inclusion in municipal records

- Registration in certain scenarios (B-Khata registration is possible)

What B-Khata restricts:

- Difficulty in obtaining OC and CC

- Limited or conditional access to utilities

- B-Khata loan challenges, especially with PSU banks

- Higher scrutiny from institutional lenders and investors

This is why many buyers ask about the B-Khata to A-Khata conversion and follow the B-Khata latest news closely. Conversion, where possible, can reduce long-term risk—but it is not automatic or guaranteed.

B-Khata vs A-Khata

In Bangalore real estate, the difference between A-Khata and B-Khata is not theoretical—it plays out every day during site visits, loan discussions, and final negotiations. For buyers, this distinction shapes confidence. For developers, it directly affects timelines, pricing power, and absorption.

Key Differences That Influence Buyer Decisions

From a buyer’s lens, A-Khata vs B-Khata quickly becomes a question of risk versus convenience.

An A-Khata property signals smoother loan eligibility, stronger resale confidence, and cleaner documentation. Buyers feel assured that banks will fund the purchase and that future resale won’t require heavy explanation or discounting.

A B-Khata property, however, introduces hesitation. Buyers worry about B-Khata home loan eligibility, future B-Khata to A-Khata conversion, and whether documentation gaps could resurface later. Even when the price looks attractive, many pause—especially end-users who depend on financing and long-term stability.

In simple terms, A-Khata simplifies decisions, while B-Khata forces buyers to evaluate trade-offs.

How Developers Experience the Difference on the Ground

Developers feel this difference immediately once sales begin. Projects with A-Khata land typically move faster through approval flows, face fewer legal objections, and maintain pricing discipline. Conversations focus on product value rather than compliance justification.

With B-Khata projects, the experience changes. Approval timelines stretch as buyers and banks seek clarity. Negotiation cycles lengthen, and pricing pressure increases as buyers factor in perceived risk. Questions around what is B-Khata property, the difference between A-Khata and B-Khata in Bangalore, and how to convert B-Khata to A-Khata dominate discussions. As a result, closures take longer, even in strong locations.

Why B-Khata Matters to Property Buyers in Bangalore

For buyers, B-Khata is not just a legal label—it shapes affordability, exit options, and peace of mind.

Home Loan Challenges & Financing Workarounds

Financing is where B-Khata matters most. PSU banks tend to be conservative and often avoid funding B-Khata properties altogether. Private banks may step in, but usually with stricter conditions, lower loan-to-value ratios, or enhanced legal scrutiny.

In end-user-driven markets, this creates friction. Buyers who depend on loans either look elsewhere or negotiate harder to offset financing risk. This is why A-Khata or B-Khata becomes an early filter—long before emotional attachment sets in.

Resale Risk, Liquidity & Long-Term Uncertainty

Resale is another critical concern. Investors and end-users view B-Khata differently.

End-users worry about long-term uncertainty—will approvals change, will resale become harder, will future buyers demand discounts? Investors focus on liquidity. A B-Khata property often takes longer to sell and typically exits at a discount compared to an A-Khata asset.

Over time, this gap widens. Properties with unresolved B-Khata status face price compression during exit, especially when market sentiment tightens.

Can B-Khata Be Converted to A-Khata?

Many property buyers and owners ask whether B-Khata can be converted to A-Khata. The short answer is: yes, conversion is possible, but only in specific cases. The process is commonly referred to as property regularisation and depends entirely on the property’s eligibility.

To apply for conversion, the property must generally meet these conditions:

- It should comply with approved zoning and land-use norms

- All outstanding property tax dues must be cleared

- Applicable betterment charges and development fees must be paid to the municipal authority

- Required documents must be submitted, including title deed, tax receipts, property sketches, and identity proofs

- A formal application must be filed with the municipal body for approval

That said, conversion is not guaranteed. Properties located on restricted land, environmentally sensitive zones, or those lacking mandatory approvals may be rejected even after application.

Because eligibility rules are strict and documentation is critical, working with a trusted real estate advisory or legal expert in Bangalore can help verify feasibility, reduce errors, and avoid false assumptions before initiating the process.

Bangalore Micro-Markets Where B-Khata Is Common

B-Khata prevalence varies across Bangalore, shaped largely by how and when different areas developed.

East Bangalore (Whitefield, Varthur, Sarjapur Road)

East Bangalore combines high demand with high regulatory compromise. Rapid growth, tech-driven housing demand, and infrastructure pressure created zones where development moved faster than approvals. As a result, B-Khata Bangalore properties are common here. Buyers often balance location advantage against compliance risk, leading to frequent discussions around B-Khata to A-Khata conversion in Bangalore.

North Bangalore (Yelahanka, Hennur, Devanahalli)

In North Bangalore, overlapping authorities and planning gaps have played a major role. Large land parcels, plotted developments, and phased approvals mean B-Khata status appears frequently. Institutional buyers and informed investors scrutinize these projects deeply, making compliance clarity crucial.

South & Peripheral Bangalore (Kanakapura Road, Anekal, Mysore Road)

In the southern and peripheral corridors, B-Khata is often tied to legacy layouts and plotted developments. Older approvals, revenue land histories, and evolving zoning norms increase risk for buyers. Here, B-Khata pricing may look attractive, but resale and financing challenges remain real.

Cost & Time Impact of B-Khata on Development Projects

At first glance, B-Khata land looks attractive. The entry price is lower, parcels are easier to assemble, and the numbers appear to work on paper. However, as projects move from planning to execution, many developers discover that the real cost of B-Khata emerges over time, not upfront.

Lower Land Cost vs Higher Business Risk

B-Khata land often offers a short-term margin advantage. Developers save on acquisition and can launch faster. Yet this early gain frequently masks a deeper issue—long-term value erosion. As buyer awareness has matured, especially post-RERA, many customers now treat B-Khata as a risk marker rather than a bargain.

As a result, developers face pricing resistance, prolonged negotiations, and requests for steep discounts. What looked like a margin win at land purchase slowly converts into weaker realisations at sale. In many cases, the project ends up earning less than an equivalent A-Khata development launched at a higher land cost.

Approval, Legal & Holding Costs Developers Underestimate

Beyond pricing pressure, time becomes the hidden expense. B-Khata projects often encounter approval uncertainty—regularisation rules change, timelines stretch, and clarity remains elusive. Developers spend months navigating legal opinions, responding to buyer objections, and managing bank queries.

Meanwhile, holding costs continue to rise. Interest on capital, overheads, and unsold inventory quietly eat into margins. The biggest loss, however, is opportunity cost. While capital remains locked in one project, competitors with clearer compliance move faster, launch earlier, and absorb demand that could have been yours.

Common Mistakes Developers Make with B-Khata Projects

Despite these realities, the same missteps repeat across the market.

Assuming Buyers Will “Adjust”

A common assumption is that buyers will compromise if the location or price looks right. That logic no longer holds. Today’s buyers depend on financing and think long-term. When loan eligibility becomes uncertain, emotional interest fades quickly. Expecting buyers to “adjust” often leads to stalled site visits and incomplete conversions.

Over-Positioning or Over-Pricing B-Khata Projects

Another mistake is premium positioning on a weak compliance base. Luxury branding, high-end amenities, and aspirational pricing do not compensate for legal ambiguity. Buyers become cautious when premium claims collide with compliance gaps. Instead of excitement, conversations shift to risk, and premium pricing collapses under scrutiny.

Poor Disclosure & Inconsistent Sales Messaging

Nothing damages trust faster than inconsistency. When sales teams downplay Khata status or offer vague assurances, buyers sense risk immediately. Once trust breaks, closures stall—even if the product is strong. Transparent disclosure, while uncomfortable, always performs better than delayed surprises.

Strategic Framework

B-Khata is not always wrong. It simply demands clear intent and realistic expectations.

Scenarios Where Developers Still Proceed

B-Khata can make sense in plotted developments, where buyers focus on long-term appreciation and self-construction timelines. It can also work in rental-yield pockets or redevelopment zones where cash buyers dominate, and immediate financing is not critical. In these scenarios, pricing aligns with risk, and buyer profiles match the compliance reality.

When B-Khata Becomes a Strategic Deal-Breaker

However, B-Khata becomes a hard stop for mid-premium and premium residential projects. Loan dependency is high, resale expectations are strict, and buyers demand predictability. Similarly, brand-led and institutional developers find B-Khata incompatible with portfolio credibility and fundraising narratives.

How Developers Can Position B-Khata Projects Without Killing Demand

Selling a B-Khata project is not about hiding risk, it’s about owning the narrative. Developers who succeed don’t avoid the topic; they address it early, clearly, and with confidence.

Transparency-Led Communication

The first rule is simple: disclose early, not defensively. Buyers respond better when B-Khata status is explained upfront—what it means, what it allows, and what it restricts. Framing matters. Instead of presenting it as a weakness, developers should explain why the project exists in its current form, what approvals are in place, and what the realistic future pathways look like.

When sales teams communicate consistently and avoid vague assurances, trust builds faster. Transparency reduces surprise, and reduced surprise shortens decision cycles.

Aligning Product, Pricing & Buyer Profile

Demand stays intact when expectations match reality. B-Khata projects perform best when product design, pricing, and target buyer profiles are aligned. Cash buyers, long-term land investors, and buyers focused on rental yield evaluate risk differently than loan-dependent end-users.

Pricing must reflect the compliance position—not fight it. When value is positioned honestly, buyers feel they are making an informed choice, not a compromised one.

Conclusion

Legal advice tells you what is allowed. Market intelligence tells you what will sell. Successful developers balance both. They assess compliance risk alongside buyer psychology, financing behaviour, and exit expectations. Without this balance, projects may be legally defensible but commercially fragile.

In today’s market, understanding buyer sensitivity is just as important as understanding approval status.

How Houzbay Helps Developers Navigate B-Khata Decisions

Houzbay works with developers at the intersection of risk, demand, and positioning. From land and approval risk assessment to buyer-behaviour mapping, Houzbay helps developers make informed choices before capital is locked in. Through strategic positioning and go-to-market planning, Houzbay enables developers to align reality with demand—turning complex B-Khata decisions into structured, de-risked outcomes.

For developers in Bangalore, clarity is not optional; it is the strategy.

FAQs

How does B-Khata affect home loan eligibility for Bangalore properties?

Most PSU banks avoid B-Khata properties. Private banks may lend, but with stricter checks and lower loan eligibility.

Do buyers still purchase B-Khata properties in areas like Whitefield and Sarjapur Road?

Yes, especially when pricing reflects risk and location demand is strong. Buyers usually factor in future regularisation or long-term holding.

What risks should developers consider before launching B-Khata projects in Bangalore?

Key risks include slower sales, pricing pressure, financing hurdles, and regulatory uncertainty. Holding costs and trust erosion can impact margins.

Can B-Khata properties be converted to A-Khata, and how realistic is it?

Conversion is possible only in specific cases and depends on policy and approvals. It is uncertain and should never be assumed upfront.

How does B-Khata impact resale value and liquidity in Bangalore?

Resale typically takes longer and requires discounting. Liquidity is lower compared to fully compliant properties.

When does developing on B-Khata land make business sense for developers?

It makes sense for plotted layouts, rental-focused projects, or cash-buyer markets. It rarely suits mid-premium or brand-led developments.