What Is BBMP E-Khata – Meaning, Benefits & Why It Matters for Property Buyers

BBMP E-Khata is a digitally issued property record maintained by Bruhat Bengaluru Mahanagara Palike (BBMP) that officially registers a property in the owner’s name. It replaces manual Khata entries with a transparent, online system. For property buyers in Bangalore/Bengaluru, E-Khata matters because it validates ownership, simplifies approvals, and reduces legal risk before purchase.

BBMP E Khata Means

In simple words, E-Khata is a digital property account created and maintained by the municipal authority—specifically Bruhat Bengaluru Mahanagara Palike (BBMP) in Bangalore. It records a property in an online system instead of the older, manual Khata registers maintained at ward offices.

Think of E-Khata as a municipal database entry that tells the local authority:

- Who the property belongs to (for tax purposes)

- Where the property is located

- What type of property is it

- How much property tax applies to it

The key shift with E-Khata is digitisation. Earlier, Khata details were scattered across physical files, ward offices, and handwritten registers. With E-Khata, all property data is stored in a centralised digital platform, making it easier to verify, update, and retrieve information.

For buyers, this matters because E-Khata:

- Reduces dependency on physical ward offices

- Minimises data tampering and duplication

- Improves transparency in property tax records

- Acts as a baseline validation check before purchasing a property

However, it’s important to understand that E-Khata is primarily an administrative and tax-related record, not a legal ownership document.

What Information BBMP E-Khata Bangalore Contain?

An E-Khata document captures key municipal details about a property. While the format may vary slightly, it typically includes the following information:

1. Owner Name

The name of the individual or entity currently recorded with BBMP for property tax purposes. This is usually updated after registration, inheritance, or transfer—but delays can happen if the owner has not applied for mutation.

2. Property ID (PID / ePID)

Every property under BBMP is assigned a Property Identification Number (PID) or electronic PID (ePID). This unique number links the property to:

- Its location (zone, ward, street)

- Tax assessment history

- BBMP’s digital records

For buyers, the PID is critical because it allows online verification of tax status and property details.

3. Property Type

E-Khata clearly mentions whether the asset is:

- An apartment/flat

- An independent house

- A residential plot

- A commercial property

This classification affects tax rates, usage permissions, and future approvals.

4. Tax Assessment Details

This section outlines:

- Annual property tax assessed

- Built-up area or plot size considered

- Usage category (self-occupied, rented, commercial, etc.)

- Payment status and arrears, if any

Buyers should always cross-check whether property taxes are fully paid and up to date, as unpaid dues can later become a liability. Together, these details make E-Khata a reference document for municipal services such as tax payments, plan approvals, and service connections.

How to Apply for E Khata Online?

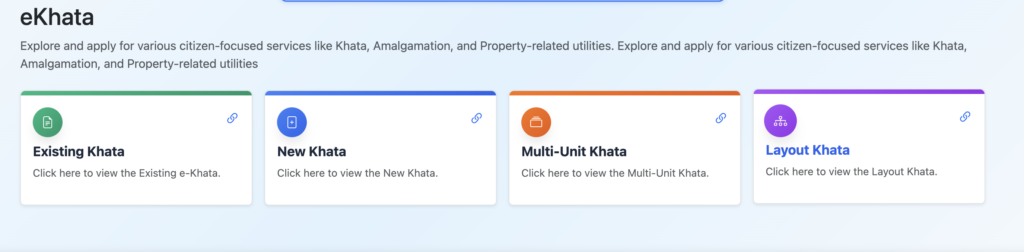

To apply for E-Khata online in Bangalore, you can complete the process digitally by following these steps:

Open the BBMP E-Aasthi Portal

Visit the official BBMP e-Aasthi website to begin your E-Khata online application.

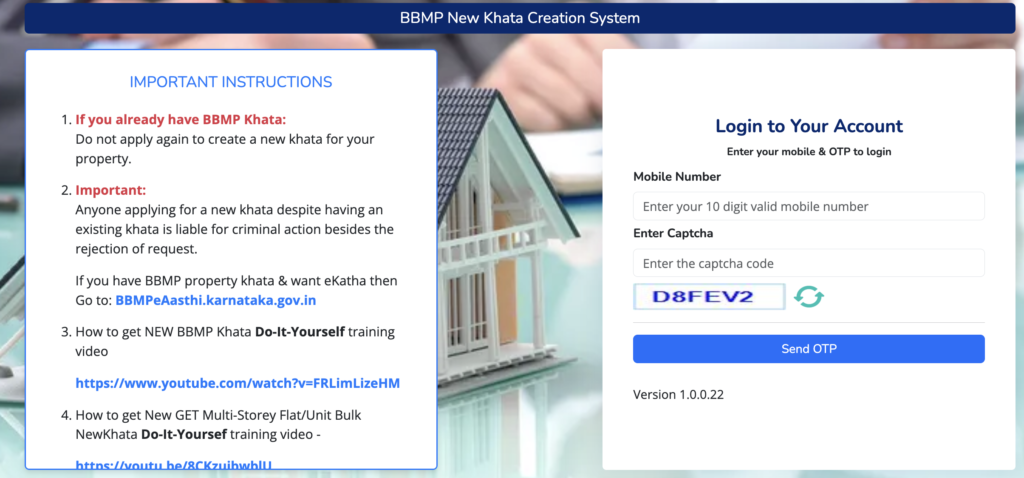

Login or Create an Account

Enter your registered mobile number and verify it using the OTP sent to you. First-time users can complete registration through the same process.

Search for Your Property

Go to the “Get e-Khata” section, select your ward, and locate your property using the PID/ePID or the owner’s name.

View Draft E-Khata

If your property appears in the database, you can view or download the draft E-Khata. If it is not listed, check again later as BBMP continues to update records in phases.

Submit Details for Final E-Khata

Click on “Submit information for final e-Khata” and provide the required information, including:

- Sale deed details (registration number or upload for registrations done before April 1, 2004)

- Encumbrance Certificate (EC) downloaded from the Kaveri 2.0 portal

- Property tax details, including the SAS application number

- PAN number and Aadhaar eKYC for identity verification

- Photographs of the property and the owner

- GPS location coordinates of the property

- BESCOM electricity connection number (10-digit)

System Verification & Approval

The portal automatically cross-checks submitted details with Kaveri and BESCOM databases. If all information matches, the E-Khata Bangalore is generated instantly. In case of mismatches, the application is sent to the Assistant Revenue Officer (ARO) for manual review.

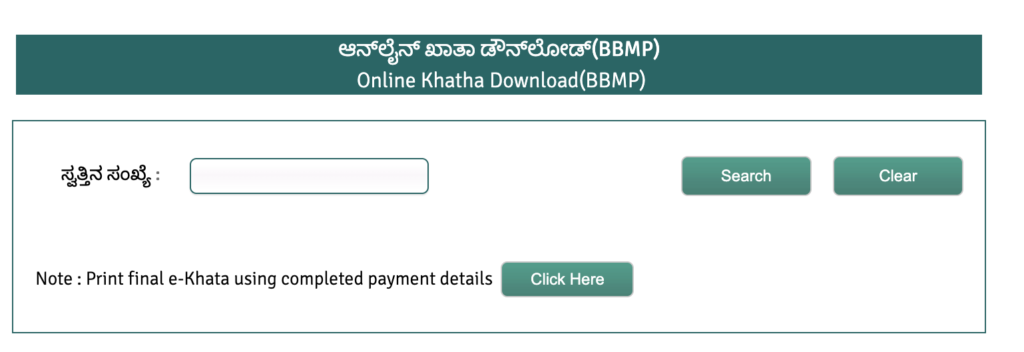

Download Final E-Khata

Once approved, you can download the final E-Khata online by paying the prescribed fee of ₹125.

What BBMP E-Khata Is NOT

One of the most common mistakes buyers make is overestimating the legal value of E-Khata. To avoid confusion, here is what E-Khata does not represent:

1. Not Proof of Ownership

E-Khata does not establish legal ownership of a property. Ownership is determined only by:

- Registered sale deed

- Chain of title documents

- Valid conveyance records

A property can have E-Khata and still suffer from title issues.

2. Not a Replacement for Sale Deed

E-Khata cannot substitute a registered sale deed. You cannot sell, mortgage, or legally transfer property based on E-Khata alone. Banks, courts, and legal authorities rely on registered documents—not municipal records.

3. Not a Guarantee of Full Legal Compliance

Having an E-Khata does not automatically mean the property:

- Is approved by all planning authorities

- Complies with zoning or land-use rules

- Has no deviations or violations

E-Khata only confirms that BBMP has recorded the property for taxation, nothing more.

Why E-Khata Was Introduced?

The introduction of E-Khata marks a major shift in how property records are maintained in Bangalore. It was not just a technology upgrade—it was a response to long-standing inefficiencies, risks, and buyer confusion within the traditional Khata system managed by Bruhat Bengaluru Mahanagara Palike (BBMP).

For years, property buyers struggled to verify records, track mutations, and trust municipal data. E-Khata was introduced to bring transparency, traceability, and buyer confidence into the system.

Problems With the Traditional Khata System

Before digitisation, Khata records were maintained manually at ward offices, leading to several serious issues, especially for buyers and investors.

1. Paper-Based Records

Khata entries existed as physical files, handwritten registers, and loose documents stored at individual ward offices. This made:

- Verification difficult

- Duplication easy

- Records are vulnerable to loss, damage, or manipulation

Two properties in different wards could follow entirely different processes, creating inconsistency across the city.

2. Delays and Uncertainty

Simple actions like:

- Khata transfer after registration

- Name correction

- Property bifurcation or amalgamation

often took months or even years, with no clear timeline. Buyers were left unsure whether their property records were officially updated—even after completing registration.

3. Dependency on Middlemen

Because the process lacked transparency, many owners and buyers had to rely on:

- Agents

- Brokers

- Ward office contacts

This increased costs, encouraged informal payments, and made the system inaccessible to first-time buyers who lacked local knowledge.

How BBMP’s E-Aasthi System Helps Buyers

To fix these gaps, BBMP introduced e-Aasthi, the digital backbone behind E-Khata.The E-Aasthi platform centralises property data across Bangalore and enables online access and tracking.

Here’s how it directly benefits buyers:

1. Online Verification

Buyers can now:

- Verify property details using PID / ePID

- Check tax payment status online

- Match seller-provided information with BBMP records

This reduces blind trust and improves pre-purchase due diligence.

2. Reduced Fraud Risk

Because records are stored digitally:

- Duplicate Khatas are harder to create

- Manual alterations are eliminated

- Property history is easier to trace

While E-Khata does not eliminate legal risk entirely, it significantly lowers municipal-level fraud.

3. Faster Mutation Tracking

E-Khata allows better tracking of:

- Ownership updates

- Tax assessment changes

- Status of Khata applications

Although timelines still vary, buyers now have visibility into the process, rather than depending on verbal updates from ward offices.

A-Khata vs B-Khata vs E-Khata

A-Khata and B-Khata define a property’s legal status, while E-Khata defines the digital format of the Khata record.

What ‘s an A-Khata?

A-Khata is issued to properties that are fully compliant with applicable laws and approvals.

- Property follows planning, zoning, and building regulations

- Eligible for bank loans and home loans

- Easier resale and registration

- Accepted for building plan approvals and trade licenses

For most end-users and risk-averse investors, A-Khata is the safest option in Bangalore.

What Is B-Khata?

B-Khata is issued to properties that are not fully compliant, but are still recorded for tax purposes.

Typical reasons include:

- Revenue land conversion issues

- Planning approval gaps

- Layout deviations

Important buyer considerations:

- Property tax can be paid

- Legal and approval risks exist

- Banks may refuse loans

- Resale can be difficult

B-Khata properties are not illegal by default, but they carry higher risk and require careful legal review.

What Is E-Khata?

E-Khata is not a separate category of property. It is simply the digital version of a Khata record.

- E-Khata can apply to both A-Khata and B-Khata properties

- It improves transparency and accessibility

- It does not upgrade a B-Khata property to A-Khata

- It does not guarantee legality or approvals

For buyers, E-Khata should be seen as a digital mirror of the property’s existing Khata status—not a legal transformation.

| Aspect | A-Khata | B-Khata | E-Khata |

| Indicates | Legal status | Irregular / partially compliant status | Digital format of Khata |

| Loan friendly | Yes | Limited / Mostly No | Depends on A-Khata or B-Khata |

| Ownership proof | No | No | No |

| Buyer safety | High | Medium to Low | Depends on underlying Khata |

| Property tax payment | Allowed | Allowed | Allowed (online) |

| Resale ease | Easy | Difficult | Depends on Khata type |

| Bank acceptance | Widely accepted | Rarely accepted | Follows Khata status |

| Legal risk | Low | High | No impact on legality |

| Primary purpose | Confirms compliance | Enables tax collection | Improves transparency |

Why E-Khata Matters for Property Buyers

For anyone buying property in Bangalore / Bengaluru, E-Khata plays a crucial role in pre-purchase validation. While it does not guarantee legal approval, it significantly improves clarity, transparency, and buyer confidence—especially when compared to the older, paper-based Khata system.

Faster Property Verification

One of the biggest advantages of E-Khata for buyers is the speed of verification.

Because E-Khata is linked to BBMP’s digital database, buyers can quickly:

- Confirm whether the property is recorded with Bruhat Bengaluru Mahanagara Palike

- Match the seller’s details with municipal records

- Verify PID / ePID, property type, and tax assessment data

This allows buyers to validate basic property credentials early, even before paying a token amount or entering negotiations. Faster verification reduces the risk of relying solely on verbal claims or outdated documents shared by sellers.

Easier Home Loan & Resale Readiness

Banks and financial institutions place high importance on clean, traceable documentation. While E-Khata itself does not make a property loan-eligible, it helps create a clear documentation trail.

From a buyer’s perspective:

- Digitally recorded Khata details are easier to submit during loan processing

- Banks can cross-check tax payment history more efficiently

- Future resale becomes smoother due to accessible municipal records

Properties with updated E-Khata are often viewed as better documented, which reduces friction during both financing and resale discussions.

Transparency in Ownership Records

E-Khata enhances transparency by eliminating data mismatches that were prevalent in manual systems.

Buyers benefit because:

- Owner names and property details are recorded centrally

- Errors can be identified and corrected more easily

- Duplicate or conflicting Khata entries are harder to create

This transparency helps buyers avoid surprises such as mismatched owner names, incorrect property classifications, or pending tax issues—problems that often surface late in the transaction under older systems.

Better Negotiation Power for Buyers

Access to E-Khata data gives buyers a strategic advantage during negotiations.

By reviewing E-Khata records, buyers can:

- Identify unpaid property taxes

- Spot inconsistencies in property type or usage

- Flag delays in Khata mutation or updates

These red flags can be used to:

- Renegotiate pricing

- Ask the seller to resolve issues before registration

E-Khata doesn’t replace legal due diligence, but it strengthens it. For buyers, it acts as a first-line filter that improves verification speed, documentation clarity, and decision-making confidence before committing to a property purchase.

When E-Khata Is Most Important

E-Khata becomes especially valuable at specific stages of the buying journey. While it is useful for all property types, its importance varies depending on what you are buying and at what stage.

Buying a Ready-to-Move Apartment

For ready apartments, E-Khata helps buyers verify post-construction compliance at the municipal level.

What buyers should check in E-Khata:

- Whether the apartment is recorded under Bruhat Bengaluru Mahanagara Palike

- Correct apartment number and building details

- Up-to-date property tax assessment

A missing or outdated E-Khata may indicate delays in handover formalities or pending updates by the builder—both of which deserve closer scrutiny.

Buying an Under-Construction Property

For under-construction projects, E-Khata is usually not available immediately.

- Whether the land parcel has a valid Khata record

- Whether the project is eligible for E-Khata post-completion

- Builder’s track record in updating Khata after handover

What to check later:

- Individual unit E-Khata generation after OC and registration

- Mutation into the buyer’s name after purchase

Buyers should treat E-Khata here as a future checkpoint, not an upfront deal-breaker.

Buying Plots (BDA / BMRDA / Panchayat)

For plotted developments, Khata status directly impacts long-term safety and resale.

Key considerations:

- BDA-approved layouts usually qualify for A-Khata

- BMRDA layouts may have B-Khata initially but can move toward regularisation

- Panchayat Khata plots require extra caution and legal review

E-Khata helps buyers confirm how the plot is recorded municipally, but approval authority and land conversion documents remain equally important.

Buying Resale Properties

In resale transactions, E-Khata is critical for ownership continuity.

Buyers must verify:

- Whether the seller’s name matches the E-Khata record

- If Khata mutation has been completed after the seller’s purchase

- Whether the property tax is paid under the correct owner’s name

A mismatch here is a common red flag and should be resolved before registration.

How to Check & Verify E-Khata Online (BBMP)

Before starting, keep the following ready:

- PID or ePID (Property Identification Number)

- Seller’s name (as per the sale deed)

- Basic property details (ward, locality)

Step-by-Step Verification Process

- Visit the e-Aasthi portal

- Choose the option to search by PID / ePID

- Enter the property identification number

- Review displayed owner, property type, and tax details

This process allows buyers to independently verify municipal records without visiting a ward office.

What a “Clean” E-Khata Record Looks Like

A clean E-Khata record typically shows:

- Owner’s name matches the sale deed

- Consistent property type and dimensions

- No pending tax dues or anomalies

Consistency across documents is the key indicator buyers should look for.

What to Do If Errors Are Found

If discrepancies appear:

- Ask the seller to apply for Khata correction or mutation

- Do not rely on verbal assurances

- Proceed with registration only after updates are reflected

E-Khata works best as a verification and risk-filtering tool. Knowing when and how to use it helps buyers avoid delays, disputes, and documentation surprises—especially in resale and plotted property transactions.

Draft E-Khata vs Final E-Khata

Understanding the difference between Draft E-Khata and Final E-Khata is critical for buyers, especially in E-Khata Bangalore transactions under BBMP.

What Is Draft E-Khata?

A Draft E-Khata is a preliminary digital record generated when property details are first captured in the BBMP E-Khata online system. At this stage:

- Data entry is completed but verification is pending

- Owner details, PID, or tax data may still be under review

- Corrections or objections can still be raised

Buyers often see sellers claim E-Khata is available when the record is only in draft status. This is risky because a draft record can still change.

What Is Final E-Khata?

A Final E-Khata is a verified and approved municipal record issued after BBMP completes checks. Only then:

- The E-Khata certificate is considered valid

- BBMP E-Khata download becomes reliable

- Property details are locked and officially accepted

From a buyer’s perspective, Final E-Khata is always safer.

What Buyers Should Prefer

Always prefer Final E-Khata because it:

- Confirms BBMP approval of recorded details

- Reduces future correction or mutation risk

- Strengthens documentation for resale and loans

Fees, Charges & Timelines for E-Khata

Typical Charges

E-Khata charges vary based on property type and transaction. Typically, buyers may encounter:

- Mutation / administrative fees

- Pending property tax dues (if any)

Avoid paying unofficial charges. BBMP E-Khata online processes reduce middleman dependency significantly.

Expected Timelines

For most properties:

- Processing: 2–4 weeks

- Final approval: 30–60 days (subject to document accuracy)

Delays often occur due to missing E-Khata documents or owner name mismatches.

Common E-Khata Issues & Red Flags Buyers Must Watch

- Owner Name Mismatch – The name on the E-Khata must match the sale deed. Any difference is a red flag.

- Pending Mutation After Sale – If the mutation is incomplete, the seller may no longer be the recorded owner in BBMP E-Khata Bangalore records.

- E-Khata Available Without Proof – Always ask for an E-Khata certificate sample or an E-Khata online download proof.

- Draft Status Stuck for a Long Time – A prolonged E-Khata status in draft mode signals unresolved issues.

What Buyers Should Remember

E-Khata significantly improves transparency, traceability, and verification, especially through the BBMP E-Khata online download and E-Khata login access. However, it does not replace legal due diligence.

Always combine E-Khata Karnataka records with:

- Registered sale deed

- Encumbrance Certificate (EC)

- Planning and authority approvals (BDA E-Khata, BBMP, or Panchayat, where applicable)

FAQs

Is E-Khata proof of ownership?

No. E-Khata is not proof of ownership. Legal ownership is established only through a registered sale deed and clear title documents. E-Khata simply confirms the property is recorded in municipal tax records.

Is E-Khata mandatory for property registration?

No. E-Khata is not mandatory for registration at the sub-registrar's office. However, BBMP E-Khata online records help with mutation, property tax payment, resale readiness, and smoother post-registration processes.

What is the difference between A-Khata and E-Khata?

A-Khata defines a property’s legal compliance status, while E-Khata defines the digital format of the Khata record. An A-Khata property may have E-Khata, but E-Khata alone does not guarantee legality.

Can B-Khata property get E-Khata?

Yes. B-Khata properties can also receive E-Khata because it only digitises records. E-Khata does not convert a B-Khata into an A-Khata or remove approval and loan-related risks.

How can I verify my E-Khata online?

You can verify E-Khata online using the PID or ePID on the BBMP e-Aasthi portal. The portal shows owner name, property type, tax status, and whether the E-Khata status is draft or final.

What is draft E-Khata vs final E-Khata?

Draft E-Khata is a preliminary record pending verification, while Final E-Khata is approved and locked by BBMP. Buyers should always prefer the final E-Khata, as draft records can still change.

Does E-Khata help in getting home loans?

Indirectly. E-Khata helps banks verify municipal and tax records, but loan approval mainly depends on A-Khata status, clear title, approvals, and compliance—not on E-Khata alone.

What if my property details are wrong in BBMP E-Khata?

Apply for correction or mutation through the BBMP with supporting documents. Avoid resale or loan applications until errors are fixed and the E-Khata online record shows matching, updated details.

How long does it take to get E-Khata updated after purchase?

Typically, E-Khata updates take 30–60 days after purchase, depending on document accuracy and mutation completion. Delays usually occur due to missing E-Khata documents or pending seller updates.